GLOBAL RECESSION RISKS ARE RISING

December 8, 2015

Last month, I discussed

how risk was rising instead of declining even though the markets had a

nice bounce off the August lows.

Risk continues to rise as probabilities are increasing that this

global slowdown may develop into a global recession.

As recession probabilities are rising, the Federal Reserve is on

track to raise rates next week for the first time in over nine years.

As usual, they are focused on lagging indicators such as the

recent employment report instead of leading indicators.

I believe the Fed

should not have gone down this path of zero rates and money printing but

this is about dealing with what the Fed is likely to do instead of what

they should do. Also, I

continue to think that either they will not raise rates next week or if

they do, the market will view it as a policy mistake afterward and they

will ultimately reverse course, as we are likely headed toward negative

rates and more money printing sometime in the New Year.

Right now, it looks more like the second scenario and that they

will raise rates. We may

hear a lot about the year 1937 next year from the pundits on CNBC.

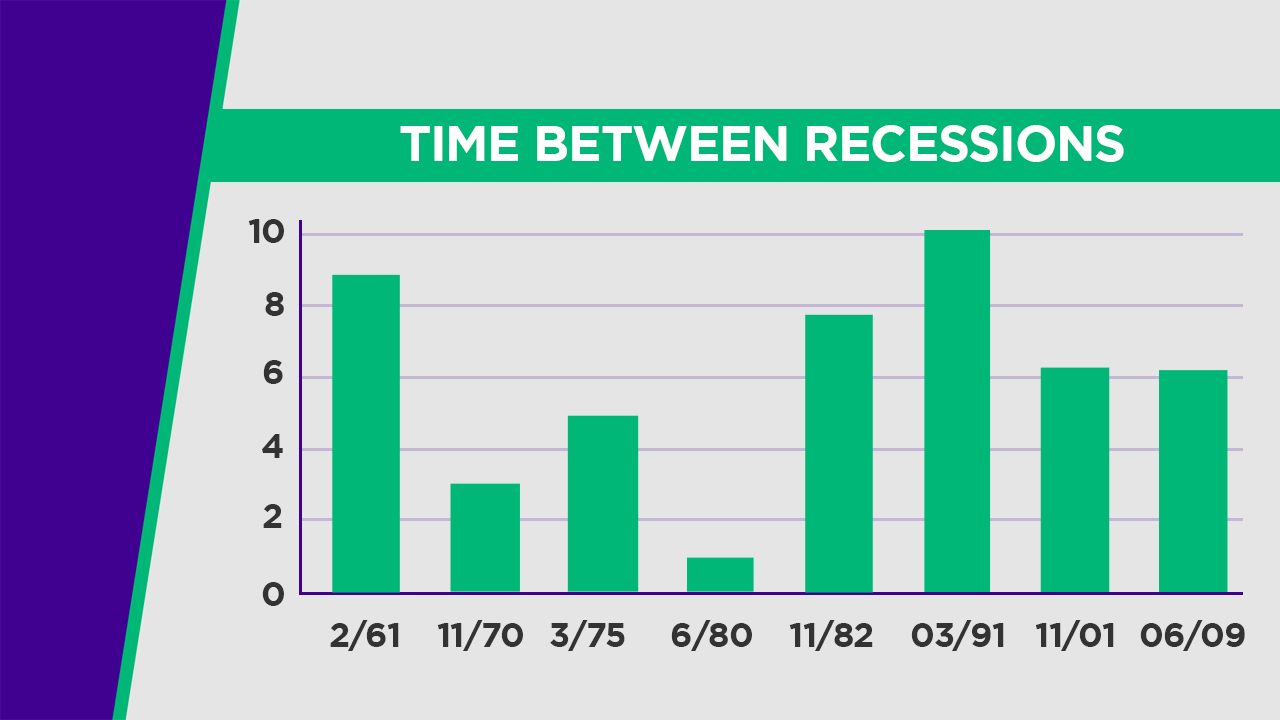

First, let’s take a

look at the average time between recessions in the chart below.

If you look at the

chart above, draw a line across at the six year mark and you can see

that it is about the average time.

The last recession ended in 2009 which happens to be a little

over six years. So, that

suggests just from a time perspective that it would not be unusual to

see another one in the near future.

If we just look at some

of the latest data on the manufacturing sector and the service sector,

we see growing weakness.

The ISM manufacturing index just reported a drop down to 48.6% with new

orders and production contracting.

A 50% reading is the break line between growth and contraction.

It was a surprise to the market that it dropped that low from a

reading of 50.1% the prior month.

The ISM services index also came in weaker than what was

expected. It was 55.9%

which still indicates expansion but it dropped from 59.1% the prior

month. Usually the

manufacturing sector leads the service sector regarding turning points in

the economy.

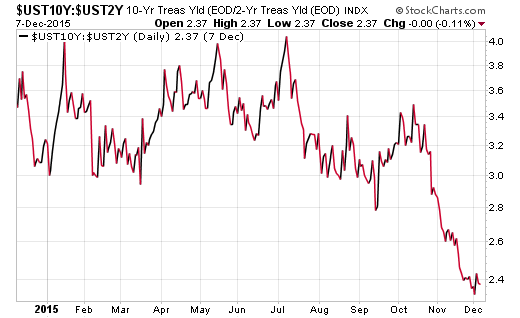

THE YIELD CURVE IS

FLATTENING…

Next, let’s look at the

yield curve or the spread between two-year Treasury yields and ten-year

Treasury yields. Often the

yield curve flattens or inverts as the economy slows or enters a

recession. Here is the

latest view of this spread.

You can see that just

in the last two months, the spread has taken a notable decline.

The short-term rates have been rising as investors believe the

Fed is going to raise rates next week while the longer-term rates are

not moving up as they typically reflect more of a view on the economy.

CORPORATE PROFITS ARE COMING

UNDER PRESSURE…

Last month, I showed

how profit margins were rolling over from an all-time high.

In that chart it highlighted that the only time profit margins

declined by 60 basis points or more without the economy either in or

just prior to a recession was in 1985.

This occurred around all six recessions since the early 1970’s

and now they have rolled over by more than the 60 basis points.

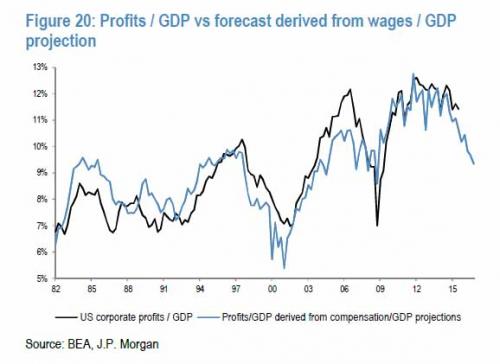

Next, let’s look at a

forecast by J.P. Morgan of corporate profits relative to GDP.

In the chart below, the blue line represents their forecast of

corporate profits as a percent of GDP based on comparing wages in the

U.S. to GDP. The black line

is actual corporate profits as a percent GDP.

If you look at the

chart above, the blue line [forecast line] tends to lead the black line

[actual corporate profits/GDP] both on the way up and the way down.

You can see how both turned down ahead of the recession in

‘01/’02 and ‘07/’09.

Recently, the forecast line has turned down sharply and suggests that

corporate profits will follow.

This would also indicate rising recession risk.

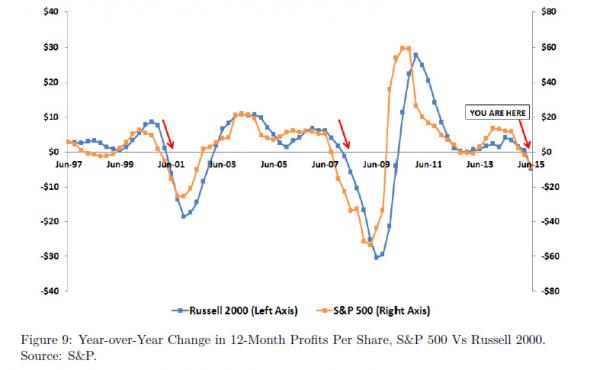

To illustrate in

another view what is happening with corporate profits, here is chart

which shows year-over-year profits for both large and small companies.

The chart above shows

profits for the S&P 500 [large companies] in yellow and for the Russell

2000 [small companies] in blue.

If you look back to the recession beginning in ’01 and the one

beginning in ’07, you see corporate profits decisively roll over into

negative territory. It is

just the past two reporting periods where profits are rolling over into

negative territory now.

CORPORATE BALANCE SHEETS

SHOWING INCREASED STRESS…

I recently highlighted

how Goldman Sachs has been discussing the deterioration in corporate

balance sheets. Let’s look

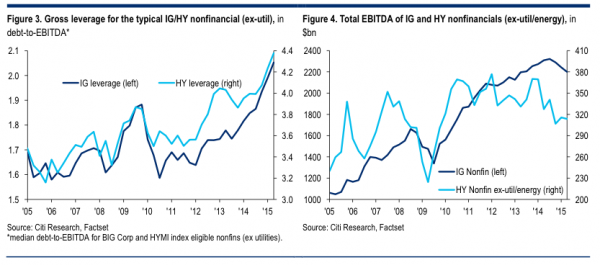

at the two charts below to see an emerging trend.

In both charts above,

the light blue line represents companies in the high yield space [ex.

utilities/energy] which have higher credit risk.

The darker blue line reflects companies in the investment grade

category with lower credit risk.

The first chart shows the median debt-to-EBITDA [cash flow].

It indicates how companies have been leveraging up relative to

their available cash flow.

The second chart shows total EBITDA [cash flow] and you can see how it

is rolling over. Also, in

the second chart, look how the investment grade companies’ cash flow

turned down in the last recession during ‘08/’09 and we are currently

seeing the largest drop since then.

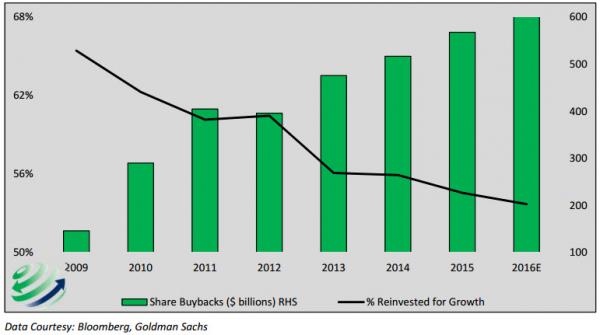

I have discussed how

capital spending has been very muted during this recovery and companies

have been issuing debt to fund buybacks.

Let’s look at the chart below to illustrate this trend.

In the chart above, you

can see how since the last recession, companies have been increasing

their buybacks which is reflected in the green bars.

Also, the amount companies are reinvesting for growth is

indicated by the black line.

This shows that companies are finding little opportunity for

investing in future growth so they are buying back stock to inflate

earnings per share. This

will likely become an issue as their debts are rising, cash flow rolling

over and they have been buying back stock instead of investing in

projects that generate future cash flow to service the rising debt.

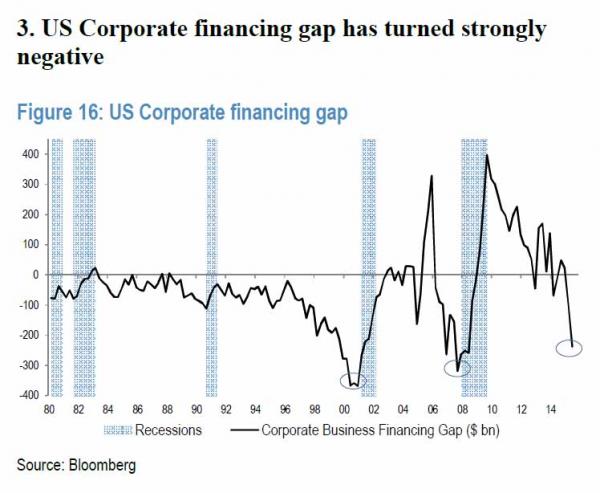

Along these lines,

let’s take a look at the corporate financing gap.

This measures the difference between cash flow coming in and the

cash flow needed to support the outflow which is spent on dividends,

buybacks and capital spending.

The chart below shows the financing gap with the black line and

previous recessions in the shaded blue areas.

You can see in the

chart above how the financing gap rolled over notably before the ‘01’02

recession and again before the last recession.

Now, once again, we see the corporate financing gap take a sharp

decline recently and it suggests a rising risk of recession.

HIGH YIELD BOND SPREADS ARE

INDICATING RISING RISK…

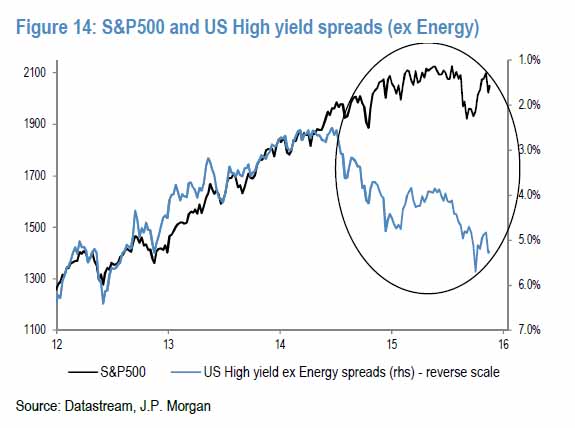

Next, let’s see what is

happening with high yield bond spreads.

These reflect companies that have higher credit risk and they are

helpful to watch since they typically come under pressure ahead of

economic slowdowns or recessions.

As economic growth slows, the cash flows of companies also slow

down or decline and those companies that have higher levels of debt face

increasing challenges in servicing their debt.

As the market begins to price in increased default risk, yields

on the bonds of those companies increase as investors require higher

returns for buying or holding the bonds.

High yield spreads

often lead both the economy and stock prices.

So, here is a chart of high yield spreads compared to stock

prices. Since the energy

sector is under unusual pressure now, this chart excludes the energy

sector so it does not artificially skew what is going on in the overall

high yield market. In the

chart, the high yield spread is inverted so when the blue line in the

chart turns down, high yield spreads are rising.

Stock prices are indicated by the black line.

You can see in the

chart above how there is a growing gap between stock prices and high

yield spreads. We saw a

similar divergence early on before the recession that began in November

of ’07 and the related decline in stocks.

GLOBAL FX RESERVES ARE

DECLINING SHARPLY…

Before I close, let’s

look at one last interesting development with global foreign exchange

reserves. Foreign exchange

reserves reflect the amount of reserve currencies [primarily the dollar]

held by global central banks.

As capital flows freely into areas of growth around the world it

usually is associated with expanding global GDP and rising global stock

prices. And, when capital flees

prior growth areas and reverts back to safe havens like the U.S. it is

often associated with slowing global economic growth and declining

global stock prices. Just

this past month, China posted its third-largest decline on record in

their foreign exchange reserves.

We are seeing this in many other emerging market countries.

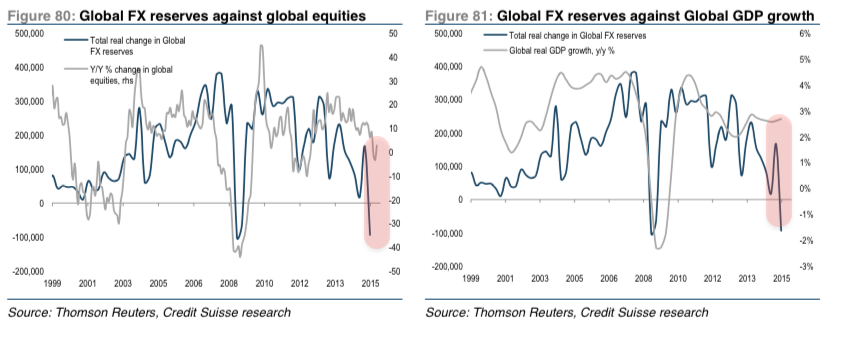

Now, let’s take a look

at the chart below which shows global foreign exchange reserves with the

dark blue line in both graphs.

In the first graph, the grey line is the year-over-year change in global

stock prices and in the second graph, the grey line is the

year-over-year change in global net GDP.

In the chart above, you

can see that the last time we saw a very sharp drop in global FX

reserves in ’08, it was associated with a sharp drop both in stock

prices and global GDP. Now,

if you look at the end of both charts, you see another sharp drop in

global FX reserves. The

growing divergence in both charts highlights another sign of growing

risk for both global stock prices and global GDP.

SHORT AND LONG-TERM DYNAMICS

CONVERGE…

Let’s wrap up for this

month. Risk has been

growing for stock prices as this year has progressed.

Now, we add in increasing risk that the global slowdown in

economic growth may develop into the next global recession.

We haven’t had one in over six years so it would not be unusual

from a time standpoint. The

various charts above as well as others I have shown recently view this

risk from a variety of angles as we don’t want to rely on any one

measure.

What is especially

interesting is that our central bank is highly likely to raise rates

next week and they are basing their decisions on mostly lagging

indicators such as the latest employment report.

If we look around the world at the other central banks, they

continue to ease more. The

ECB just expanded their money printing by around six months so they are

going to keep printing at least until March of 2017.

Draghi basically said QE is here to stay.

Not only did they expand the time of printing, but they also cut

the deposit rate further into negative territory and said that they were

going to widen the available securities they would buy with the printed

money into regional and local government bonds.

In addition to Europe,

Canada’s central bank announced today that the effective lower bound for

monetary policy in their country is -0.5%; that Canadian financial

markets could function in a negative rate environment; and that they are

ready to act. It is a

timely announcement as their economy looks to be headed into a

recession. By the way,

remember, a few weeks ago both Yellen and Dudley [the two most

influential members of our central bank] squarely put negative rates on

the table for acceptable policy here in the U.S. as they have “studied”

the effects in Europe and view that the benefits outweigh any side

effects.

The key North American

central banks are signaling that negative rates may be crossing the

ocean and coming onto our shores and Canada may be the first to strike.

As a side note, expect China to devalue their currency in the

near-future as a monetary easing; David Tepper and other prominent macro

investors expect up to a 30% devaluation.

Also, remember the

discussion on the long-term and short-term debt cycles two months ago in

my commentary. The last

peak in the short-term debt cycle was in 2007.

The average time to the next peak is around 7 to 8 years and it

has been 8 years since the last peak.

If the short-term debt cycle reconnects with the long-term debt

cycle on the way down amidst another global recession, significant

turmoil in the financial markets will reappear.

Back in late’07,

central banks around the world had not printed any money except Japan

and the Fed Funds rate was over 5%.

Essentially, the global central banks had lots of ammunition to

fight a sharp global recession and stress in the financial system.

Now, we are sitting at the zero bound with over $12 trillion of

money printed around the world by central banks and the efficacy of

incremental monetary policy has been shown to have less of an impact.

All of the extreme

monetary policies have created significant asset price inflation which

is disconnected to the reality of the underlying fundamentals.

A global recession and reconvergence of the debt cycles would act

as a catalyst for prices to reconnect with fundamentals especially as

the fundamentals deteriorate.

I have highlighted the

saying before, “It takes long for things to happen than you thought they

would, but when they happen, they happen faster than you thought they

could.” Just think back to

late 2007 and if I told you General Motors, Wachovia, AIG, Lehman

Brothers, and other companies would either go bankrupt or would be

bailed out by the government, you would have thought I had lost my mind.

At the time, these companies were showing little to no signs of

stress at all and would have been in the investment grade category of

companies. Then, in less

than a year it all happened.

We are living in a time

where debt is saturated all over the globe and the long-term debt cycle

has likely turned. In a

time of a deleveraging, things tend to happen that seem out of the realm

of possibilities. Just

think of all the financial events, economic dynamics and extreme

monetary policies since 2007.

Be mindful of the long-term macro picture and alert to the recent

developments that are emerging as rising risks can be reflected in

prices quicker than you think.

Joseph R. Gregory, Jr.