HAS RISK EVAPORATED?

November 7, 2015

Let’s recap the price

action in the market for the year so far.

Stock prices essentially went sideways for 7 months until August

arrived. However, a number

of dynamics were developing prior to August that suggested weakness was

ahead and the market was coiling up like a spring ready to release.

Then in mid-August, the market broke to the downside and the Dow

slid 2,200 points in 5 days.

The market continued its volatility until the end of September.

Since then, we have seen market prices bounce back up to where

they were before the market dropped and are essentially flat for the

year once again.

Market participants

have waffled back and forth regarding thoughts on the global economy,

especially China, and what direction the Fed is likely to take with

monetary policy. Early in

the year, the market was expecting the Fed to begin raising rates.

Then, due to economic weakness and slowing global growth,

expectations flipped to pricing in very little chance they would start

to raise anytime this year.

Currently, thoughts have turned full course back to believing they will

raise interest rates in December.

It is increasingly

looking like the Fed is basing their monetary decisions on the moves in

the stock market and looking for any confirmation in the economy to

support getting off the zero bound.

You can overlay comments by members of the Fed on the price of

the stock market and see that they communicated that they were likely to

raise when stock prices were up and then reversed course when stock

prices dropped. The Fed is

turning their focus more and more to very short-term measures, and in

the environment we are currently in, it results in causing even more

uncertainty since it seems as though they are changing their minds

weekly.

In the midst of all

these changing and seemingly conflicting economic and market data, let’s

try to step back and see if anything has really changed much over the

last few months. Before we

look at a few indicators, we need to address the strong employment

report just released for the month of October.

Remember, the report last month was weak and was one of the

primary reasons market expectations for a rate hike subsided

significantly. Now, we get

a strong report and expectations regarding the Fed flip back the other

way. For now, the Fed is on

a clear path to raise in December but this could still change before we

get there. Let’s shift over

to look at a few broader economic indications than just the latest

employment report.

CURRENT ECONOMIC MEASURES ARE

NOT TRENDING HIGHER…

We can use ECRI’s

[Economic Cycle Research Institute] U.S. Coincident Index to get a good

sense of broad economic activity since it is a composite measure of

aggregate output, employment, income and sales.

This is a broader measure than just GDP.

In the chart above, you

can see that broad-based economic activity has been slowing since the

first of the year and has not started to turn back up.

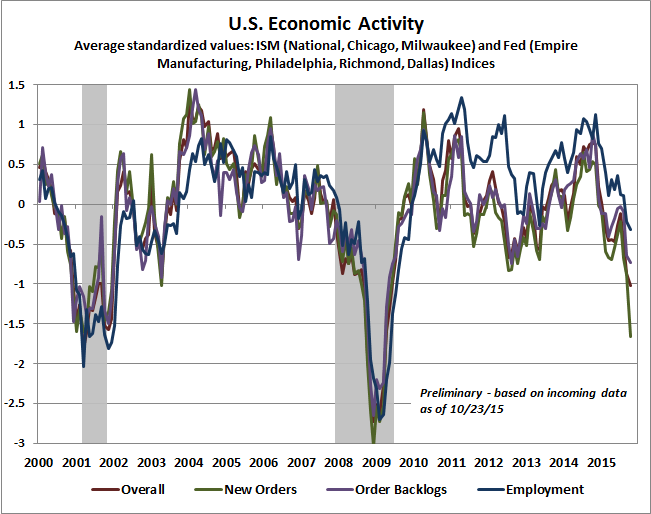

We can also look at a

chart by John Hussman which shows a number of economic activity

measures.

In the chart above, you

can see an overlay of a variety of economic indicators and he has shaded

the two previous recessions.

The direction and level of these measures shows how the economy

has been slowing.

LEADING ECONOMIC INDICATORS

ARE NOT TURNING HIGHER…

So, you can see from

the previous two charts that broad economic growth has been slowing for

much of the year. Does this

one employment report suggest that things are about to change and

economic activity is going to improve?

Well, the employment report

is generally not a good leading indicator of what’s to come and

can be quite variable as we have seen from just the past two reports.

Therefore, let’s take a look at a leading indicator that has been

pretty good in suggesting growth over the next quarter or two.

This is ECRI’s Weekly Leading Index.

While their Coincident

Index captures a very broad measure of economic activity, their Weekly

Leading Index tends to give an indication of GDP readings about one to

two quarters out. If you

look at the chart above, you can see the weakness at the end of last

year which suggested the economic weakness in the 4th quarter

2014 and the 1st quarter of this year.

Then, the rebound at the beginning of the year in their Weekly

Leading Index forecasted the rebound in GDP for the 2nd

quarter of this year. The

Index then rolled back down beginning in May and forecasted the renewed

weakness in 3rd quarter GDP.

It is interesting that the index continues to decline, which

suggests that growth is not likely to strengthen in the coming months

and may actually weaken further.

CORPORATE EARNINGS ARE

DECLINING…

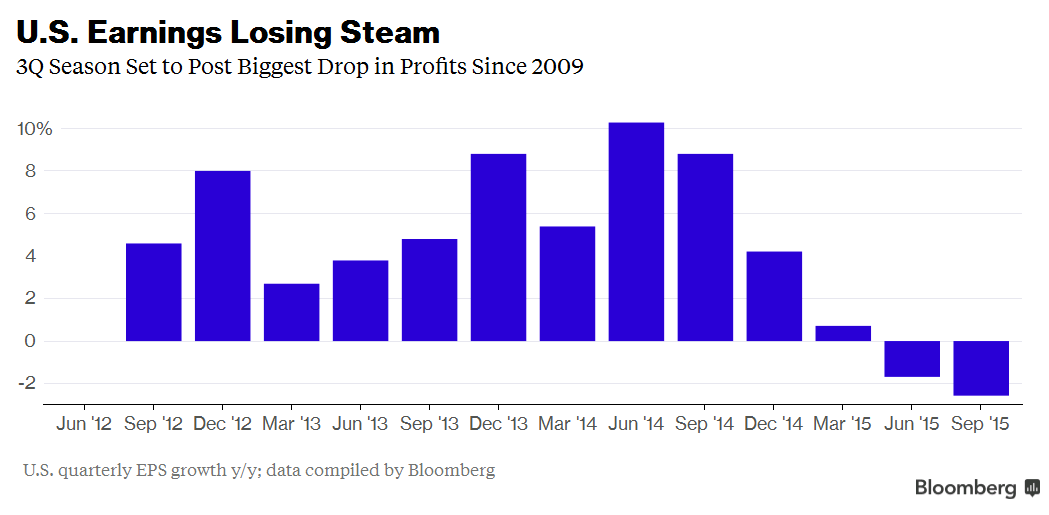

Now, let’s see what

effect the economy has had on recent earnings.

Bloomberg just reported that, “So far, about three-quarters of

the S&P 500 have reported results, with profits down 3.1 percent on a

share-weighted basis. This

would be the biggest quarterly drop in earnings since the third quarter

2009, and the second straight quarter of profit declines. Earnings

growth turned negative for the first time in six years in the second

quarter this year.” A

notable impact has been from energy and commodity related companies but

overall earnings have been muted and top line revenue growth even

weaker. Here is a Bloomberg

chart of earnings.

BASE METALS ARE STILL NOT

RISING…

It is not surprising

that commodity related company earnings have been weak since the

underlying commodity prices have been weak.

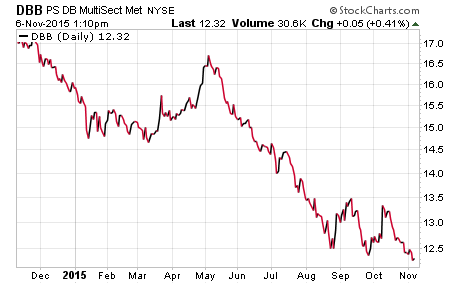

Here is a chart of a basket of base metals and does not include

the weakness in the oil markets.

These are base metals that are used in the global economy.

You can see the

temporary strength during the 2nd quarter of this year which

coincided with the better GDP report that quarter.

Then, the weakness that followed in the base metals was also

accompanied by weakness in the 3rd quarter GDP.

Currently, base metal prices have not turned higher and further

suggest that the strong employment report for October may not be an

indication of broader economic strength, especially globally.

CORPORATE PROFIT MARGINS ARE

ROLLNG OVER…

Now, where the stronger

employment report may have an upcoming impact is on corporate margins

with hourly incomes rising.

It appears that this may be a result of increases in the minimum wage

and the impact we are seeing with employment costs at companies like

Walmart. So, let’s take a

look at corporate profit margins from a historical perspective.

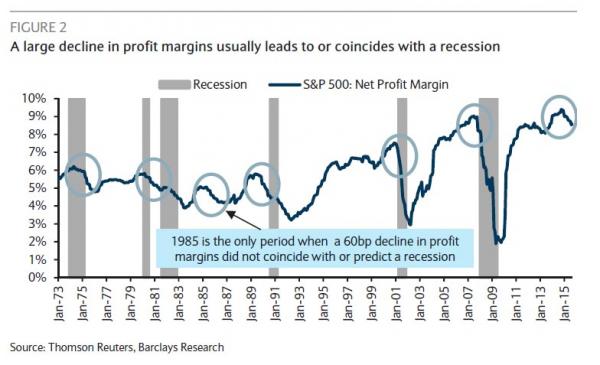

Here is a chart of profit margins going back to 1973.

The chart above shows

profit margins with the blue line and the periods that are circled

indicate declines in profit margins by at least 60 basis points.

Previous recessions are the shaded areas.

The note on the chart in the blue rectangle indicates that 1985

was the only time where a 60 basis point decline in profit margins or

more did not coincide with or predict a recession.

As you can see at the end of the chart, profit margins have

rolled over from an all-time historical high and we will see if it turns

out to be only the second time we have seen this without a recession in

over 40 years.

CORPORATE DEBT HAS INCREASED

SIGNIFICANTLY…

While we are discussing

corporate earnings and profit margins, let’s also touch on corporate

debt. The consensus

thinking is that corporations continue to be flush with strong balance

sheets and plenty of cash.

However, more and more companies have been issuing debt fueled by the

ultra-easy monetary policy and much has been used to buy back stock.

Here are some highlights from a Bloomberg article on October 14th.

“Companies have loaded

up on debt. They owe more

in interest than they ever have, while their ability to service what

they owe, a metric called interest coverage, is at its lowest since

2009, according to data compiled by Bloomberg.

The deterioration of balance-sheet health is ‘increasingly

alarming’ and will only worsen if earnings growth continues to stall

amid a global economic slowdown, according to Goldman Sachs Group Inc.

credit strategists led by Lotfi Karoui.

Since corporate credit contraction can lead to recession, high

debt loads will be a drag on the economy if investors rein in lending,

said Deutsche Bank AG analysts led by Oleg Melentyev, the bank’s U.S.

credit strategy chief. ‘The

benefit of lower yields for corporate issuers is fading,’ said Eric

Beinstein, JPMorgan Chase & Co.’s head of U.S. high-grade strategy.

As of the second quarter, high-grade companies tracked by

JPMorgan incurred $119 billion in interest expenses over the last year,

the most for data going back to 2000, according to the bank’s analysts.”

“The fallout of more

borrowing coupled with lower earnings has raised concern among the

analysts who track the debt and the money managers who buy it.

Yet it seems the companies themselves are acting as if it’s not

happening. They’re still paying out record amounts in buybacks and

dividends. In the second

quarter, the most creditworthy companies posted declining earnings

before interest, taxes, depreciation and amortization.

Yet they returned 35 percent of those earnings to shareholders,

according to JPMorgan.

That’s kept their cash-payout ratio -- how much money they give to

shareholders relative to Ebitda -- steady at a 15-year high.”

“The borrowing has

gotten so aggressive that for the first time in about five years, equity

fund managers who said they’d prefer companies use cash flow to improve

their balance sheets outnumbered those who said they’d rather have it

returned to shareholders, according to a survey by Bank of America

Merrill Lynch. Since May,

stocks of companies that have spent the most buying back their shares

have performed even worse than the S&P 500 index.

That comes after buyback stocks outperformed the S&P 500 each

year since 2007, according to data compiled by Bloomberg.”

This article is talking

about high grade corporate debt, not junk bonds.

It is important to highlight that all this debt is not being used

for capital investment projects for future growth but instead has been

used to buy back stock to juice earnings per share in an environment

that has offered slow to no top line revenue growth.

Stanley Druckenmiller just this week discussed how everyone has

turned very short-term in their focus including the Fed, CEO’s,

investors, etc.

A company that has

excessive cash levels over and above what dividends they need to support

at comfortable payout levels as well as needs for capital investment to

fund future growth can be used productively to buy back their own stock.

However, companies are usually not good at this as they often buy

back the most shares near stock market peaks and high valuations and buy

back few shares after big price declines and at low valuations.

In the world of low to no top line revenue growth, levering up to

fund stock buybacks at the current high valuations to support short-term

earnings-per-share growth is likely to come back an haunt those CEO’s

and their respective Boards.

This will turn out to be another unintended consequence of

profligate monetary policy.

MORE NEGATIVE YIELDING ASSETS

AROUND THE GLOBAL…

Before I close for this

month, let’s take a brief look at a few global dynamics.

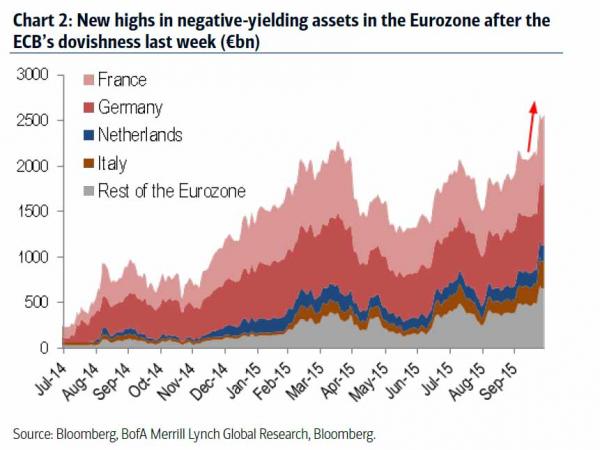

First, the amount of negative yielding assets in Europe continues

to increase as the following chart illustrates.

Deflationary pressures

continue to increase and the European Central Bank indicated last week

that they will likely add to their already $1 trillion a year run rate

in money printing. China is

likely to continue to cut rates and even here in the U.S., 3-month

Treasury Bills auction at 0% a few weeks ago.

It is also important to note that in the past two weeks, the two

most prominent Fed members [Yellen and Dudley] both said that negative

rates here in the U.S. are on the table if they perceive it is

warranted. Going negative

here in the U.S. like many parts of Europe was previously thought of as

extreme and would never happen.

It is no small change in thinking at the Fed for these two

members to clearly state that negative rates are a viable policy tool.

CAPITAL CONTINUES TO FLOW OUT

OF EMERGING MARKETS…

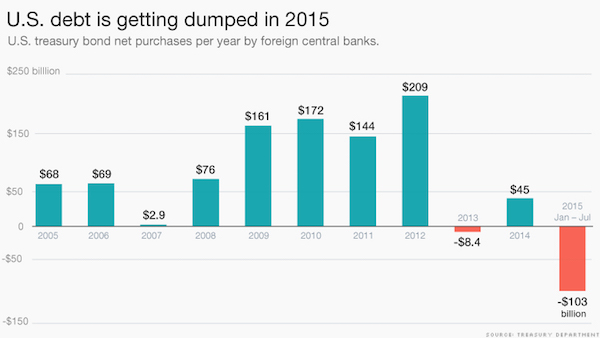

Due to the slowdown in

China and the related impacts to growth around Asia, capital is flowing

out of emerging market economies.

It is impacting capital reserves and as a result U.S. Treasury

bonds are being sold. Here

is a chart that reflects this recent dynamic and it is likely to

continue and may accelerate.

Let’s go ahead and wrap

up for this month.

The latest employment

report has turned market expectations to thinking that growth may be

picking up and that the Fed is going to raise rates in December, after

having the opposite view of both as recently as a few weeks ago.

This flip-flopping is likely to continue.

Also, it is worthwhile to note that the “strong” employment

report for October continues to show that it is the low paying, low

quality jobs that showed strength and that is where minimum wage

pressures are found most.

Growth has been

weakening around the globe and here in the U.S. for most of the year,

and in view of ECRI’s leading indicator it does not appear that the

economy is likely to improve in the coming months.

In fact, it may continue to weaken.

This has impacted corporate earnings, and profit margins continue

to roll over from all-time highs.

Corporations have issued large amounts of debt to fund stock

buybacks for short-term earnings performance and as a result we are

starting to see signs of balance sheet deterioration.

Deflationary pressures

continue around the globe, and as more interest rates are going lower

and into negative territory, our central bank just put going below the

zero bound on the table.

Currently, market participants believe the Fed will raise rates in

December. However, I

continue to think that the data will either continue to weaken enough

before their meeting in December and they will not raise, or they will

raise and the data will weaken afterward and they will reverse course as

claims of a “policy mistake” surface.

I would have preferred that the Fed never went to the zero bound

or printed money but this is more about what is likely to happen than

what should happen.

DRUCKENMILLER’S PERSPECTIVE…

As for market

implications, let’s look at what Stanley Druckenmiller said in an

interview this week at a New York Times investment conference.

I have highlighted Druckenmiller many times as he is probably the

best investor in the last 50 years.

“You’re pulling demand forward today, this is not some permanent

boost. You’re borrowing

from the future,” Mr. Druckenmiller said. “The chickens will come home

to roost,” warned Mr. Druckenmiller, who has been a frequent and vocal

critic of the Fed and its policy of near-zero interest rates.

“I can see myself getting very bearish, I can’t see myself

getting bullish,” he said. Mr.

Druckenmiller also told the audience that some of his best returns had

been in “great periods of chaos.”

One of his important

perspectives that he shared is that he is currently operating under the

assumption that a primary bear market started in July.

If he is correct, the declines in August and September were the

first wave down and this subsequent bounce in stock prices will roll

back over and we will see prices break below the lows in August.

Although investors have

become bullish once again as a result of the latest bounce this past

month, risk remains high.

If Druckenmiller is right, we will see what Yellen and Dudley put on the

table of acceptable monetary policies this past week become reality in

2016. The investing

environment will become even more interesting if the majority of the

world’s interest rates go negative for the first time in history.

Joseph R. Gregory, Jr.