TURBULENCE IS GROWING

September 9, 2015

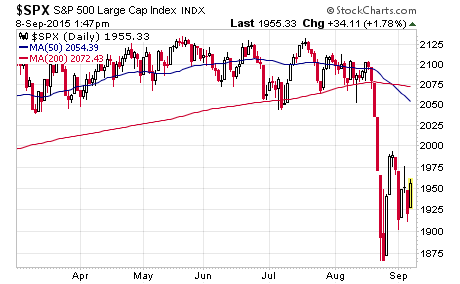

Last month, I discussed

how risk was rising and that it was time to “fasten your seatbelts” for

increased volatility. That

volatility arrived in August as the chart below of the S&P 500

illustrates.

Starting on August 19th,

the S&P 500 dropped 11% in just four days and the Dow dropped over 2,000

points over the same four days.

So, the question on

everyone’s mind now is whether or not the decline is over.

Let’s highlight a few dynamics in play to see what may be the

likely answer.

First, let’s take a

look at the economic fundamentals.

As we look around the globe, most economies are slowing down, if

not already in recession.

China continues to slow rapidly, the European central bank just lowered

their outlook for the Eurozone, Japan continues to be very weak, Canada

just entered into a recession, most all of the commodity centric

countries continue to slow such as Australia and Brazil and the rest of

Asia is very weak as evidenced by the significant drop in exports from

South Korea.

In the midst of this,

most of the economists here in the U.S. continue to believe that our

economy will not be affected by the global weakness and were encouraged

by the 3%+ reading of 2nd quarter GDP as well as the

employment report last week.

Let’s take a look at global trade and then more squarely on the

U.S. economy.

GLOBAL TRADE CONTINUES TO

WEAKEN…

I highlighted a few

thoughts early in the year by ECRI [Economic Cycle Research Institute]

on global trade and they have recently published an update.

Below are their latest comments.

“After years of

extraordinary policy stimulus around the globe – aimed at pulling demand

forward from the future – world trade growth has collapsed even further

(top line in chart) since we last highlighted it publicly.

Indeed, year-over-year (yoy)

world export growth is now nearing zero.”

“This is happening even

with everything ‘on sale’ as yoy export price growth has plunged deep

into negative territory (bottom line). After

some four years of falling export prices, export price deflation had

become almost as intense as in the depths of the Global Financial Crisis

(GFC).”

“In essence, we have a

shrinking trade pie. Unable to

generate adequate domestic growth, economies are trying to grab a larger

share of that pie through competitive devaluation.

As we observed earlier, this

amounts to war by other means, and all that’s happened recently is that

it’s China’s turn to devalue. “

“As we’ve shown, global

debt has grown to some $200 trillion, with debt-to-GDP ratios having

risen in every major economy. These

debts can be repaid over time either by generating sufficient real

growth to do so; or by inflating away the debts, so that they can be

repaid in currency that is worth much less.”

“But, as ‘the yo-yo

years’ make clear, real GDP growth has been stair-stepping down for

decades in most advanced economies. In

conjunction with the yo-yo years, export prices are exhibiting

increasingly severe deflationary patterns – in both advanced economies

and emerging markets.”

“Under the

circumstances, in the fullness of time, all the major economies are

likely to face a day of reckoning. Though

this journey may well involve a rush to a succession of ‘safe’ assets en

route to that destination, many economies are all effectively circling

the drain.”

“The last time export

price deflation was this intense, not only was Chinese GDP growth even

weaker than it is today, but also every G7 economy was in recession.

It is ominous that the global

trade pie is shrinking so rapidly today – with none of the G7 economies

in recession – yet.” [note:

these comments were as of August 17, before some of the latest global

economic news such as Canada entering a recession and China beginning to

devalue their currency].

GLOBAL ECONOMIC WEAKNESS IS

COMING ONTO OUR SHORES…

Next, let’s look at the

latest leading economic indicator for the U.S. by ECRI [Weekly Leading

Index Growth Rate]. This

index tends to lead the economy by about three to six months.

The chart above shows

their leading indicator dropping notably during the 4th

quarter last year. This

decline gave an indication that economic growth would weaken.

First quarter GDP turned out to be only 0.6%.

Then, ECRI’s leading indicator turned back up sharply during the

1st quarter of this year.

Subsequently, 2nd quarter GDP rose to 3.7%.

Now, their indicator has turned back down and the decline is

getting steeper. If it

continues to anticipate growth here in the U.S., we are likely to see

weakening growth this quarter.

As the global economy has weakened, it looks to be spilling over

onto our shores.

WORDS OF WISDOM…

Now, let’s put the

recent backdrop of economic indicators into a broader perspective with

the help of Ray Dalio from Bridgewater.

He is one of the better macro thinkers and runs the largest hedge

fund in the world. Here are

some of his comments from his latest investor letter.

“That's where we find

ourselves now—i.e., interest rates around the world are at, or near 0%,

spreads are relatively narrow (because asset prices have been pushed up)

and debt levels are high.

As a result, the ability of central banks to ease is limited, at a time

when the risks are more on the downside than the upside and most people

have a dangerous long bias.

Said differently, the risks of the world being at or near the end of its

long-term debt cycle are significant.”

“That is what we are

most focused on. We believe

that is more important than the cyclical influences that the Fed is

apparently paying more attention to.

While we don't know if we have just passed the key turning point,

we think that it should now be apparent that the risks of deflationary

contractions are increasing relative to the risks of inflationary

expansion because of these secular forces.

These long-term debt cycle forces are clearly having big effects

on China, oil producers, and emerging countries which are overly

indebted in dollars and holding a huge amount of dollar assets—at the

same time as the world is holding large leveraged long positions.”

“While, in our opinion,

the Fed has over-emphasized the importance of the ‘cyclical’ (i.e., the

short-term debt/business cycle) and underweighted the importance of the

‘secular’ (i.e., the long-term debt/supercycle), they will react to what

happens. Our risk is that

they could be so committed to their highly advertised tightening path

that it will be difficult for them to change to a significantly easier

path if that should be required.

We believe that the next big Fed move will be to ease (Via QE)

rather than to tighten."

He updated his thoughts

a few days later by saying, “We don’t consider a 25-50 basis point

tightening to be a big tightening.

While we might see a tiny tightening akin to what was experienced

in 1936, we doubt that we will see anything much larger before we see a

major easing via QE.”

I have also quoted

Stanley Druckenmiller many times, as he has been probably the best

investor of our time. He

has been pushing the Fed to get off the zero bound for a while and just

recently came out and said they missed their opportunity and now they

probably won’t raise rates until at least 2017.

As the markets move

through these volatile days, it is easy to get caught up in the trees

and lose sight of the forest.

Dalio and Druckenmiller are two of the best macro thinkers around

and what they are implying by their comments is ominous to say the

least.

Dalio is anticipating

that there is the possibility that the Fed may go ahead and increase

rates in the upcoming meeting but will subsequently reverse course and

start printing money again in a significant way.

I have said recently that either the Fed will not raise in this

month or if they do, it will be later viewed as a policy mistake and I

think Dalio is suggesting a similar scenario.

If they raise rates this month and then we get a weak GDP number

for the 3rd quarter like ECRI is suggesting, the financial

media will be squawking “policy mistake” by the Fed over and over.

That is the near-term

caution by Dalio, but his comments about nearing the end of the

long-term debt cycle has much more implications for a meaningful shift

in one of the more important secular trends regarding global debt.

I have addressed this many times before and will save additional

comments for a later paper.

Nonetheless, Dalio’s comments are worthwhile to think through in the

midst of increasingly short-term attention spans by investors.

To be clear, I was

never in favor of the Fed going to the zero bound in the first place,

much less starting the printing press.

I have said many times that Bernanke led the world down this path

and that the unintended consequences will be very significant.

While many still think he saved the financial system in 2008, I

believe history will ultimately view his policy decisions as going down

a path that led to much greater financial problems and to be the worst

mistakes since the Fed was formed about 100 years ago.

In fact, I think his policy decisions will ultimately lead to the

elimination of the Federal Reserve as we know it and that a much

improved structure based more on market forces will hopefully emerge.

Remember, the current structure is a room full of academics who

have mostly never operated in the private sector setting monetary policy

based on their economic models, forecasts and theories.

Bottom line is that the

Fed has dug themselves deep into a hole and Dalio as well as

Druckenmiller anticipate that rather than starting to climb out, they

are likely to get an even bigger shovel.

That also implies that there are very important developments to

the global economy on the horizon.

To continue this

discussion on the Fed, let’s take a look at some data relating to their

two mandates; maximum employment and price stability [even though they

have dramatically expanded their mandate over the last two decades to

encompass much more than what is outlined in their charter].

First, let’s look more closely at the employment picture.

LOW QUALITY JOBS…

The Fed and other

economists have been pointing to the jobs numbers as one area of

strength in the economy. In

addition to the factors such as the participation rate, part-time

employment and other dynamics that are making the employment picture

seem better than the real situation; there is another interesting

development behind the numbers.

We can use data from ECRI again here to highlight this.

“The sustained decline

in the official jobless rate – now approaching the Fed’s estimate of

‘full employment’ – is a misleading indicator of labor market slack.

Indeed, the stagnation in nominal wage growth is consistent with

the weakness in the employment/population (E/P) ratio.

That said, even the E/P ratio may be overstating the health of

the jobs market.”

“After dropping to

three-decade lows in the wake of the Great Recession, the E/P ratio, has

barely improved since the fall of 2013, reversing only about one-fifth

of its decline from its pre-recession highs.

Furthermore – as a breakdown of the E/P ratio by education level

shows –this modest improvement is illusory.”

“Since 2011, when the

E/P ratio for those with less than a high school diploma bottomed, that

metric has regained almost two-thirds of its recessionary losses (orange

line in chart). But the E/P

ratio for high school or college graduates – i.e., eight out of nine

American adults – has not recovered any of its recessionary losses, and

stands about where it started, one, two and three years ago (purple

line).”

“This data shows that

the so-called jobs recovery has been spearheaded by cheap labor, with

job gains going disproportionately to the least educated — and

lowest-paid — workers. This

is scarcely a good basis for resilient consumer spending driven by

‘solid’ job growth that the consensus – including the Fed – is banking

on.”

INFLATION EXPECTATIONS ON THE

DECLINE…

Now, the second part of

their mandate is price stability.

Here is a chart of market-based expectations of inflation from

Bloomberg. This chart also

lines up the inflation expectations according to the time intervals of

their Quantitative Easing events [QE, or printing money].

You can see by this

chart that the initial round of money printing had the most impact on

inflation expectations and each subsequent round had less and less

impact. Since QE ended,

inflation expectations have weakened further.

Combine the thoughts of

Dalio on the potential ending of the long-term debt super-cycle with the

quality of the jobs market and declining inflation expectations, and you

can start to see why he thinks the next major Fed policy will be another

large round of printing more money.

NEW USES OF MARGIN DEBT…

Now, let’s shift gears

to look at a newer form of margin that investors have pursued.

It is often called “non-purpose loans” which they get from their

financial institutions.

Here is a summary from the Wall Street Journal.

“Loans backed by

investment portfolios have become a booming business for Wall Street

brokerages. Now the bill is

coming due—for both the banks and their clients.

Among the largest firms, Morgan Stanley had $25.3 billion in

securities-based loans outstanding as of June 30, up 37% from a year

earlier. Bank of America,

which owns brokerage firm Merrill Lynch, had $38.6 billion in such loans

outstanding as of the end of June, up 14.2% from the same period last

year. And Wells Fargo & Co.

said last month that its wealth unit saw average loans, including these

loans and traditional margin loans, jump 16% to $59.3 billion from last

year.”

“In a securities-based

loan, the customer pledges all or part of a portfolio of stocks, bonds,

mutual funds and/or other securities as collateral.

But unlike traditional margin loans, in which the client uses the

credit to buy more securities, the borrowing is for other purchases such

as real estate, a boat or education.

Securities-based loans surged in the years after the financial

crisis as banks retreated from home-equity and other consumer loans.

Amid a year’s long bull market for stocks, the loans offered

something for everyone in the equation: Clients kept their portfolios

intact, financial advisers continued getting fees based on those assets

and banks collected interest revenue from the loans.”

So, investors have now

essentially used margin loans not only for buying more stocks but also

to support their spending habits [i.e., buying real estate and boats].

Traditional margin debt is used to buy liquid securities so if

margin calls come from declining security prices, either the investor or

the financial institution can sell down their loan balance immediately

because stocks can be sold daily.

Now, think through what happens when the loans are used to buy

illiquid assets such as real estate and boats and a margin call comes in

as a result from declining stock prices.

As the clients will struggle to get liquid on the assets

purchased with the loans, there will be ever increasing pressure to

liquidate much more from their stock portfolios.

This is just yet another example of the ongoing speculation due

in large part to profligate monetary policies.

CAUTION FLAGS ARE STILL OUT…

Let’s close for this

month. In August, the

market broke down out of the tight range it had been in the whole year

with a very sharp initial move lower.

We are now seeing a bounce off short-term oversold conditions.

The bounce may go a little further in price but it is likely to

end relatively soon in time and roll back over and break below the lows

in August. The longer-term

structural issues continue to build and we may be closer to an important

inflection point if Dalio is correct.

For now, keep your seatbelts fastened as more turbulence is to

come.

Joseph R. Gregory, Jr.