FASTEN YOUR SEATBELTS

August 7, 2015

In my last commentary,

I discussed how volatility was increasing in a number of areas of the

market. The major indices

have not broken down yet and this has masked the building weakness under

the surface of the market.

Let’s continue our review from last month with updates on the current

condition of the financial markets.

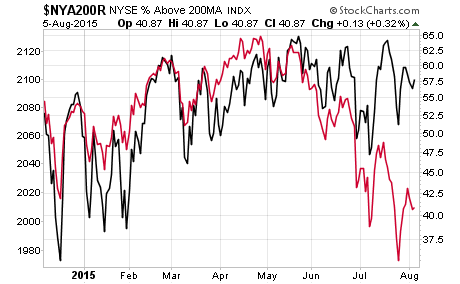

To start, let’s look at

another indicator that reflects how the broader range of stocks is

performing. The 200-day

moving average is often used as a longer-term trend line for the price

of a stock. It is a simple

average of the price of the stock over the last 200 trading days.

It is just one trend line that can be used to get a sense of

whether the stock is in a longer-term move higher or whether it is

starting to trend lower.

The chart below shows the percentage of stocks trading above this

longer-term trend line for the NYSE, a very broad composite of stocks.

The above chart shows

the percentage of NYSE stocks trading above their 200-day moving average

with the red line and the S&P 500 with the dark line.

The red line shows that about 65% of stocks were trading above

their long-term trend line back in late April and then the percentage

started to decline. The S&P

500 peaked about a month later and has been in a volatile range sideways

since. Over the past few

months more and more stocks have been breaking down below their trend

lines and the divergence between the performance of most stocks and the

major indices has been growing.

This gap between the two lines is likely to close in the next

month or two and suggests that further weakness is ahead.

EXTRACTING ALL THE EARNINGS

YOU CAN…

From a fundamental

perspective, earnings growth has outperformed top line revenue growth

for some time now. Trend

economic growth as reflected by GDP has persisted around the 2% range,

which impacts revenue growth.

Two dynamics have inflated earnings growth at a higher rate than

usual. One is that profit

margins rose to all-time highs over the past few years and have yet to

revert back to the long-term average.

Typically, as long as capitalism is working this is one economic

variable that is very mean reverting, which Jeremy Grantham has

repeatedly discussed.

Second, the extreme monetary policy has encouraged excessive issuance of

debt to fund stock buybacks instead of investing in capital projects and

this inflates earnings per share in the near-term.

These two dynamics have been going on for the past few years and

may run its course before long as far as extracting as much earnings per

share possible out of the tepid top line revenue growth.

THE FED BETTER HOPE THEIR

ATLANTA COUNTERPART IS WRONG…

It is interesting to

note that the Atlanta Fed has an economic forecasting model that has

been more accurate than most in the recent period for predicting

near-term GDP growth. The

Federal Reserve Board should probably pay a little more attention to it.

So, their latest forecast for 3rd quarter real GDP

growth was just released at a whopping 1%.

Here is a chart which shows the consensus forecast by economists

on Wall Street compared to the Atlanta Fed forecast.

This chart shows that

the consensus is currently over 2% more than the Atlanta Fed which

highlights rising probabilities of disappointment for the markets and

continued weak top line revenue growth.

BASE METALS SUGGESTS GLOBAL

ECONOMIC WEAKNESS…

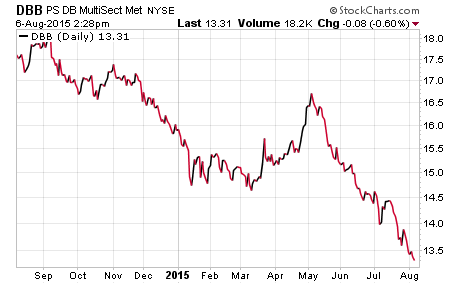

Next, let’s take a look

at an index of base metals which includes copper, aluminum and zinc.

One reason for looking at the prices of base metals is that these

are heavily used in the economy and can give at least an indication of

global growth.

This chart above shows

a dramatic decline in the prices of base metals.

China has been the marginal buyer of these types of commodities

so it is definitely being impacted by the slowdown there.

However, if the other economies around the world were growing at

a healthy rate, it would help stabilize pricing.

This suggests that the global economy continues to weaken and the

likelihood of upcoming economic disappointment.

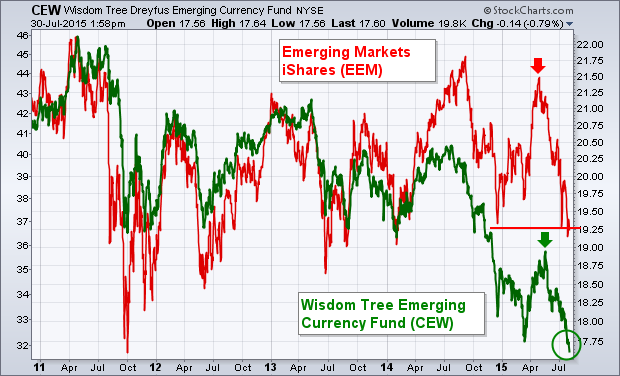

EMERGING MARKET RISKS…

The decline in

commodity pricing, the slowdown in China and the rising U.S. dollar is

also pressuring emerging markets.

One area to monitor as a clue to the direction of the emerging

market stocks are their currencies.

John Murphy of StockCharts recently highlighted two charts on

this topic. Let’s take a

look.

The chart below shows a

basket of emerging market currencies in green and the emerging market

index in red.

The chart shows that

the currencies and the stock markets tend to correlate together.

In the last year, the currencies have begun to weaken more

dramatically and have recently diverged from the stocks.

The currencies are suggesting that a break down in emerging

market stocks may be coming.

The next chart shows a longer-term view of emerging market

stocks.

This chart shows that

the emerging market stocks sitting right above the red trend line and

the currencies suggest that this trend line may be broken soon.

“POLICY MISTAKE” IN THE EYES

OF THE MARKET JUST AHEAD???

Now, let’s tie this in

with the primary focus of the market right now, and that is whether or

not the Fed is going to raise rates a quarter of a point off the zero

bound in September. As I

have said many times, the Fed should never have taken rates to zero and

should not have started up their printing press as these actions distort

market prices, encourage the misallocation of capital and eventually

leads to more pain for the economy and investors.

They have maintained this extreme monetary policy for so long

that they are backed into a box.

So, the Fed seems

intent on getting off the zero bound no matter what in September.

I continue to believe that

either they will not raise rates this year or if they do, the market

will later view it as a policy mistake.

They will likely get cold feet and decide to hold off, but if

they do raise in September, imagine what market participants will say if

the Atlanta Fed model comes true for the 3rd quarter.

If they raise and subsequently, 3rd quarter GDP comes

in anywhere near 1%, the pundits on CNBC will flip as will markets.

Going down the policy path that Bernanke created has

unfortunately made the markets much more linked to future policy

decisions than we have historically seen.

It is going to get

interesting as we move through the next three months.

Market internals are weakening, the economy continues to slow,

commodities continue to decline, and other signs of stress are appearing

such as in emerging markets.

And, the Fed seems intent on raising rates.

Risk is rising and August through October has often been unkind

to markets. Make sure your

seatbelts are fastened as the ride may start to get bumpy.

Joseph R. Gregory, Jr.