VOLATILITY ON THE RISE

July 8, 2015

Last month, I discussed

how volatility was rising in the bond markets around the globe.

In the last few weeks, that volatility has spread to stock

markets.

The two primary global

dynamics that the market is watching is the increasing probability that

Greece may exit the European Union and more importantly, the crash going

on in the Chinese stock markets.

The decline in China has accelerated to the point where their

government is halting the trading in what Bloomberg identifies as 43% of

their entire market.

Imagine halting the stocks in 43% of the companies that trade on the

U.S. stock exchanges due to declining prices.

The Chinese have not

identified when those companies will re-open for trading.

That means that holders of those stocks are stuck and don’t know

when they will be able to get out and have no idea what the prices will

be when they re-open. Now,

consider that investors were buying Chinese stocks with record amount of

margin debt. So, many of

the holders of the stocks that have been halted own them with borrowed

money. As the overall

Chinese market declines further, it triggers more margin calls.

Since investors can’t raise money by selling the stocks that are

halted, they have to sell from the stocks that continue to trade.

That adds increased selling pressure for the overall market.

As the Chinese market

went parabolic early in the year, record amount of new trading accounts

were opened meaning that more and more people in China were piling in at

prices meaningfully above where prices are today.

This will likely create additional weakness in the Chinese

economy and we are seeing that reflected by the drop in many commodity

prices such as iron ore and copper.

MARKET WEAKNESS IS EXPANDING…

While we are seeing

increased volatility around the globe, it is still relatively muted with

the major indices in the U.S.

We have seen declines such as a day recently with the Dow

dropping around 350 points but the S&P 500 is still down less than 5%

from the highs, although both the Dow and the S&P 500 are negative for

the year. Probabilities for

further declines are increasing.

Let’s look at a few charts.

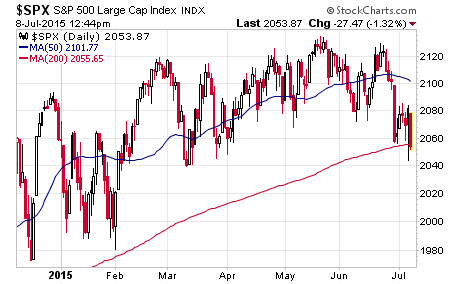

The first chart is a

chart of the S&P 500 for the last 7 months.

The blue line is the

50-day moving average and the red line is the 200-day moving average.

The market essentially bounced off the 200-day moving average at

the end of January. Then,

the S&P 500 dropped down to the same support line at the end of June and

tried to bounce like it did in late January.

It has retested it again a few more times in recent days.

Now, let’s look at a few more charts that suggest the odds are

increasing that the market will likely break down through this support

area and add to recent declines.

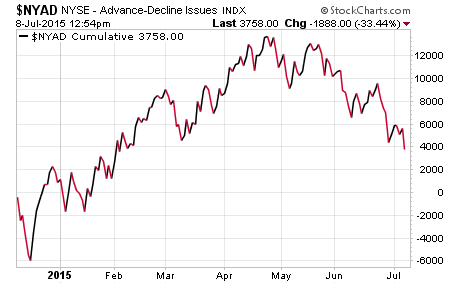

Here is a chart of the

advance-decline line which takes the number of stocks going up each day

and subtracts the number of stocks going down and runs a cumulative

number. It is one measure

of market breadth. When the

line is rising it indicates that there is broad participation among

stocks to the upside which is a healthy sign.

When it is declining, it indicates that an increasing number of

stocks are going down. This

indicator often leads the market in overall direction.

Here is this indicator over the same 7-month period.

If you compare this

chart with the one of the S&P 500, you can see that the advance-decline

line peaked in late April and then the S&P 500 peaked later toward the

end of May. This line

continues to make lower lows and has not shown any signs yet of turning

back up.

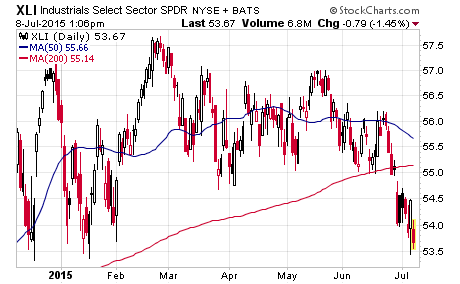

Next, let’s look at

some of the more economically sensitive areas of the market.

First, here is the index of industrial companies.

This chart shows that

the industrial index has broken through the 200-day moving average.

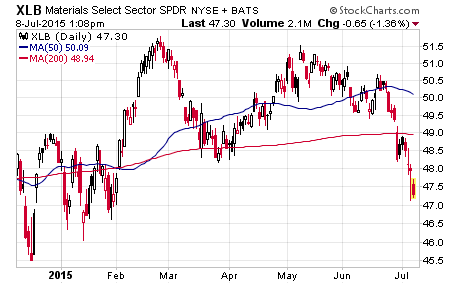

Now, let’s look at the materials index which are companies

involved in basic materials used in the economy.

Here, we see a similar

break of the 200-day moving average.

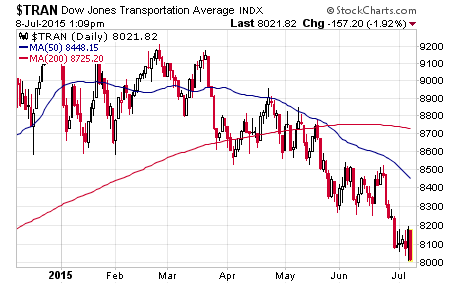

Next, let’s take a look at the transportation index which

consists of companies that move goods in the economy.

While earlier weakness

in the transports was blamed on the airlines, weakness is spreading to

the truckers and logistics companies.

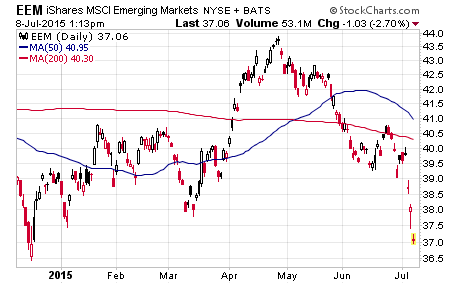

Next, let’s look at the emerging markets index which is no

surprise that we see weakness here.

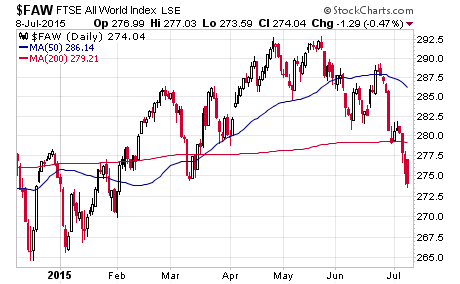

Lastly, let’s look at

an all-world index which gives a picture of global markets.

The chart shows that,

it too, has broken down through the 200-day moving average.

The 200-day moving

average is one technical trend line that market participants watch as it

is an average price of the last 200 trading days.

It provides a relative metric to compare prices across indices.

When multiple key indices are breaking down below trend lines, it

often suggests that risks are rising.

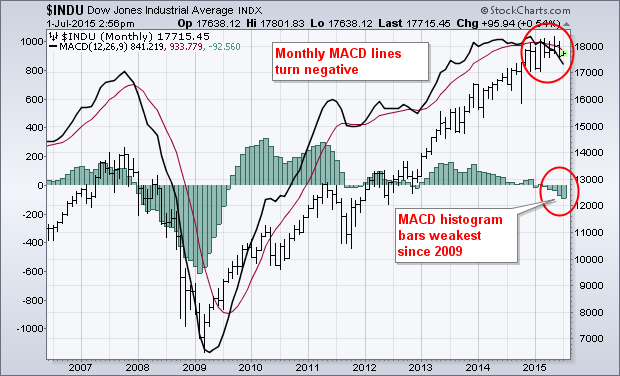

StockCharts regularly

has technical updates. One

recent update included a chart of monthly prices for the Dow and an

overlay of the monthly MACD indicator.

Without going into the details of how that indicator is created,

it is a price oscillator that compares trend lines from moving averages.

Here is the chart.

This chart goes back to

2006. The candlestick line

is the Dow, and the red and black moving average lines represent the

trend lines within the MACD indictor.

The bars on the chart represent the spread between the two trend

lines. When the market

reached a major peak in late 2007, the MACD started to turn down in a

significant way as indicated by the increasingly negative bars.

Then, when the market reached the lows in early 2009, the bars

started to turn back up and have stayed above the zero line for most of

the time since then, except for just a few months where it went slightly

negative. Now, if you look

at the end of the chart, you can see that the MACD has rolled over and

the bars are the most negative since right after the last major peak.

This indicator, just

like other technical indicators is not something to rely on by itself

but offers another clue as you put the overall big picture into

perspective.

LONGER-TERM PROSPECTS FOR THE

ECONOMY…

Now, let’s shift gears

to highlight another perspective on the economy.

Here is a brief commentary from ECRI [Economic Cycle Research

Institute] which suggests what we may see from the economy from a

longer-term perspective. I

have discussed this dynamic before but this commentary sheds additional

light on the topic.

“Recoveries have been

weakening due to declines in growth in output per hour (i.e.,

productivity), growth in hours worked, or both.

Taken together, they add up to

real GDP growth. It’s just simple math.”

“For the past four

years, productivity growth (green line) has averaged just over ½% per

year (red line), leading Fed Vice Chairman Stanley Fischer to lament

that it ‘has stayed way, way down.’

Given the latest data, one could say that the U.S. is in a

‘productivity recession,’ having seen the largest back-to-back quarterly

productivity declines in 22 years.”

“It’s often assumed

that productivity growth will rebound to its post-World War II average –

around 2¼% per year (gold line).

But you know what they say about assumptions.

To quote Fischer again, ‘productivity is extremely difficult to

predict,’ and ‘will perhaps eventually return’ to its earlier pace.

In other words, there’s no clear reason why that will happen

anytime soon. Indeed, since

the end of 2013, productivity growth has averaged minus 0.7% a year.”

“Potential labor force

growth (blue line) should reflect the long-term trend in growth in hours

worked. But the

Congressional Budget Office says it will stay at ½% per year at least

for the next decade. This

is pretty much set in stone, given the demographics.”

“Adding up the likely

trend growth of these two measures – ½% for productivity plus ½% for

hours worked – gives us just 1% longer-term real GDP growth.”

“So, unless there’s

good reason to believe that productivity growth will revive, trend GDP

growth may very well stay stuck in the 1% range for years to come.

If so, growth slowdowns could much more easily push growth below

zero, leaving very little room for error.

Is the Fed ready?”

This perspective by

ECRI suggests that economic growth will remain muted if productivity

does not rebound in a notable way since demographics indicate that the

long-term trend in the growth in hours worked is likely stuck at ½% per

year. Since the last

recession in 2008, capital spending has been relatively weak as

companies use capital to buy back stock rather than invest in capital

equipment. This is based

partly on their outlook for return on capital and the uncertainty

throughout the economy. The

weak capital spending will likely continue to keep productivity

relatively weak.

This leads to a quick

comment on the Fed. Given

all the uncertainty around the globe such as with Greece and China and

the increasing volatility in financial markets, I continue to think the

Fed will not raise rates this year.

Couple the volatility with continued muted economic growth and

they will rationalize to remain on the zero bound.

They want to make one quarter point hike just to get off zero,

but they will likely be too afraid to move.

ANOTHER AREA OF EXCESS…

As I close this month,

I want to highlight another growing issue in the economy that is a

result of this ultra-easy Fed policy.

It is in the car market.

Here is a highlight from Bloomberg; “Demand for automobile debt

in the U.S. is enabling lenders to make longer loans to people with

spotty credit, stoking concern that car shoppers are being lulled into

debt loads they won’t be able to sustain.

Of the subprime vehicle loans bundled into securities, 73 percent

now exceed five years, up from 64 percent during the first three months

of 2014, according to data from Citigroup Inc.

Loans as long as seven years are increasingly being put into more

bonds as auto-finance companies and Wall Street banks sell the

securities at the fastest pace since 2007.”

Sound familiar to the

housing market in 2006? All

the buyer cares about is the monthly payment, and zero rate Fed policy

coupled with extending the term allows you maintain “affordability.”

All the banks and auto-finance companies care about are the

origination fees and Wall Street gets the securitization fees in the

process. And, investors

relax their guard and rationalize buying the loans in the search for

yield. A similar dynamic is

in place as the housing market; now we get to see just how far it will

go! Once again, we see a

Fed policy that encourages debt, creates moral hazard, fosters an

unhealthy appetite for risk by savers, and enables the enablers to scalp

fees in the process of origination/securitization.

When this blows up, the bailouts will come once again and will

make the “cash for clunkers” program back in the last recession look

like nothing.

Let’s close for this

month. Volatility is

growing in the financial markets around the globe.

Risk is rising as evidenced by a number of charts that I

discussed. Between now and

the end of October is traditionally the more volatile time of the year.

And, we are just entering earnings season which should highlight

continued muted economic growth.

But have no fear; we still have the Federal Reserve to protect

us, right?

Joseph R. Gregory, Jr.