572

June 8, 2015

In my commentaries over

the last number of years, I have discussed the impact of global central

bank policies on both the economy as well as the financial markets.

That has been the primary driver of the movement in asset prices

and will continue to be for some time.

Central banks around the world have been cutting interest rates

for eight years and collectively have printed over $11 trillion of new

money to try to revive economic growth.

This graphic by Bank of America helps to put the magnitude of one

side of monetary policy into perspective.

As the central banks

have reduced returns on low risk assets with the most aggressive

monetary policy in history, money has moved increasingly into riskier

assets in search of some return.

As money chases returns in riskier and riskier assets classes,

the yields as well as future prospective returns on those assets go

lower and lower.

The central banks

should not have entered this game of extreme monetary policy because the

deeper they go into this abyss the harder it gets to escape back out.

Targeting asset price inflation to garner a wealth effect; then

turning to currencies to gain a competitive trade advantage, and

continuing to encourage the massive growth of debt creates all kinds of

distortions in the economy and financial markets.

It has also muted asset price volatility which has given

investors a false sense of stability and has pushed complacency to

greater and greater extremes.

SIGNS OF VOLATILITY…

However, over the past

7 months or so, volatility is starting to emerge in a number of areas of

the financial markets. If

this continues to grow and spread to other areas of the market, things

may get interesting for the central banks.

So far, volatility has been increasing in the currency markets,

commodity markets and more recently the bond markets.

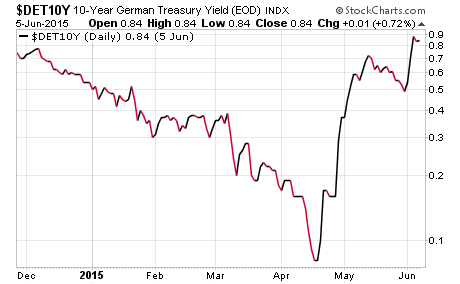

We can look at the recent movement in the yield of the 10-year

German Bund. This is an

equivalent of our 10-year Treasury Bond.

If you look at the

first 2/3rds of the chart above, you can see that the yield on the

10-year German Bund had been declining due to interest rate cuts in the

EU as well as all the new money printed by the European Central Bank.

At the lows in April, you could lock up your money for 10-years

in German government bonds at an annualized yield of 0.06%.

That means that if you put $10,000 into those bonds and held them

to maturity, you would receive a total of $60 in interest by the end of

the 10-year period, or $6 per year!

Now, look at the end of

the chart and you can see a massive reversal.

While the yield is still very low it has jumped by 14 times, or a

1400% change. This kind of

volatility change looks more like an extreme move in a small emerging

market country, not something that comes from one of the most mature

bond markets in the global financial system.

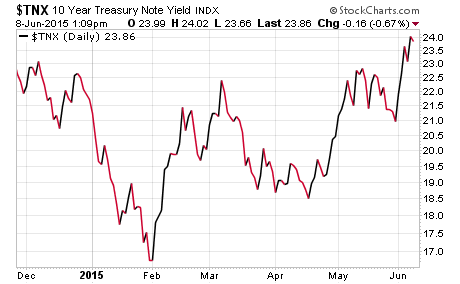

Next, let’s take a look

at 10-year Treasury Bond yields.

While the volatility is much less than the German market, the

yields here are moving in the same direction.

The chart above shows

that the yield on the U.S. 10-year Treasury Bond has moved from about

1.65% at the end of January to about 2.4% recently.

As all of the yields

around the world collapsed in so many areas of the market, investors

have moved into stocks to try to get some return on their money.

If interest rates on “safe” assets like government bonds continue

to rise and the Fed starts to raise short-term rates, investors may

start the process of reversing this “relative return” trade that has

been in process over the life of the 572 rate cuts by central banks

since 2008.

SAME TUNE…

This month, we can keep

the discussion relatively short.

It’s the same old game:

-

Debate continues as to whether the Fed will or

won’t raise rates this year.

-

Corporations continue to issue debt to buy back

stock to engineer earnings per share growth since there is little top

line revenue growth.

-

Margin debt continues to expand and now is up to

$507 billion which is 50% higher than the last bubble peak in 2007.

-

Capital spending by corporations and

productivity continues to be anemic as CEO’s remain cautious about

committing capital to longer-term projects.

-

Etc………

A FEW SIGNS TO MONITOR…

The key dynamic to

watch right now is in the bond market.

If the recent volatility continues we will likely get some

interesting price movements in other markets over the summer months.

One final note.

The Dow Jones Industrial Average just went negative for the year

and the Transportation Average is down over 8% for the year.

The idea behind tracking these two is that many of the companies

in the Dow Index produce products while the companies in the

Transportation Index deliver those products to the customers.

One sign of a healthy market is when these two indices are

trending higher with the Transports leading the way.

Lately, both have started to roll over somewhat with the

Transports leading on the downside.

Also, a number of the market breadth indicators have been

weakening.

All the liquidity

coming from the central bankers have been the juice for this market for

a long, long time. 572…

that’s a whole lot of rate cuts… that the world has never seen… an

average of one every three trading days…

Wow! That means a

whole lot of rate increases by global central banks to get back to

normalized monetary policy and our Fed can’t even take the first baby

step of 25 basis points out of fear of what it may do to our economy and

asset prices. Seems like a

fragile foundation underneath sky high asset prices to me.

Joseph R. Gregory, Jr.