THE COURSE PRESCRIBED BY KEYNES

April 9, 2015

This month let’s

continue our discussion regarding the evolving global economic landscape

in the world of unprecedented monetary policy.

Increasingly, central bank policies are driving the pricing of

assets; as asset prices become more disconnected from underlying

fundamentals. While prices

continue to rise, economic weakness persists but that does not matter in

an environment where any return is better than nothing found in low risk

instruments, courtesy of our Federal Reserve.

The danger lies in the fact that the deteriorating marginal

prospective return from various asset classes lies juxtaposed to a

significant and widening probability of meaningful losses when prices

reconnect to reality. The

Fed has engineered an uninterrupted climb in pricing so that investors

are willing to accept lower and lower returns in the belief that any day

of reckoning is sufficiently far away or simply will not happen for the

fact that it has not happened yet after all this time.

The Economic Cycle

Research Institute [ECRI] recently penned an article that identifies

what may be coming next from global governments in the wake of continued

economic weakness. The

following text is from a piece from April 1 titled “Circling The Drain.”

“The world today is

awash in unprecedented amounts of debt – more than ever before in human

history. According to

McKinsey, all major economies today have higher Debt/GDP ratios than in

2007, with corporate debt about 1.5 times, and government debt over 1.75

times as large. As a result,

global debt has grown to some $200 trillion.”

“In the aggregate, the

two ways these debts can be repaid over time are by generating

sufficient real growth to do so; or by inflating away the debts, so that

they can be repaid in currency that is worth much less.”

“As we have pointed out

before in the context of ‘the yo-yo years,’ real GDP growth has been

stair-stepping down for decades in most advanced economies.

More recently we have also noted

that export prices – especially for emerging economies – have been

exhibiting deflationary patterns for years, and those for advanced

economies are also showing deepening deflation (International Cyclical

Essentials, January 2015).”

“The hard reality is

that there is no magic bullet to get stronger growth – certainly not QE,

which merely attempts to pull demand forward from the future, leaving

even less residual demand for later. The

other way out of the debt trap – generating inflation – is not really

possible through currency devaluation because, in the aggregate, the

pressures are on every economy to devalue along with others.”

“At best, economies can

take turns devaluing their currencies, as they are doing now, but

without much success in igniting inflation.

For instance, Japanese core

inflation, adjusted for last year’s tax hike, has now dropped to zero.”

“The larger point is

that, in the fullness of time, all the major economies are likely to

face a day of reckoning – and earlier than most expect.

Sooner or later, the prospects

of default or an equally unpalatable alternative like much higher taxes

is likely to loom. But the

process may involve a rush to a succession of ‘safe’ assets in the

interim, even though all of these economies are effectively circling the

drain.”

“Desperate but

ineffectual efforts to attain ‘escape velocity’ or even the inflation

target are failing, despite round after round of QE.

To quote John Maynard Keynes

from eight decades ago, ‘When the rate of interest has fallen to a

very low figure and has remained there sufficiently long to show that

there is no further capital construction worth doing even at that low

rate, then I should agree that the facts point to the necessity of

drastic social changes directed towards increasing consumption.

For it would be clear that we

already had as great a stock of capital as we could usefully employ.’

What drastic social changes the

present situation might ultimately require remains to be seen.”

IT’S NOT WHAT YOU CAN DO FOR

YOUR COUNTRY, BUT WHAT WE CAN DO FOR YOU…

Instead of following

the more prudent economic thought found in Austrian economic beliefs

which disagree with Keynes, our political leaders including the Federal

Reserve believe that Keynesian philosophies that promote the government

doing more and more in times of economic strain work best.

It is probably more their wanting to convey to their constituents

“all that they are doing to help them” and/or for the retention of

power, instead of a true understanding of the economic consequences,

that make virtually all governments pursue the ideals of Keynes.

Therefore, if we are

going to continue to be led by the belief that government is the answer

in times of economic weakness instead of letting free markets work, we

should pay attention to the quote by Keynes in the article from ECRI.

Let me quote it once again since it has significant ramifications

to what may be coming sooner than later.

“When the rate of interest has fallen to a very low figure and

has remained there sufficiently long to show that there is no further

capital construction worth doing even at that low rate, then I should

agree that the facts point to the necessity of drastic social changes

directed towards increasing consumption.

For it would be clear that we already had as great a stock of

capital as we could usefully employ.”

Let’s take a look each

part of his statement briefly.

Interest rates are at zero and have been there for going on seven

years. And, the economy

remains very weak with muted capital spending.

That should be sufficient to satisfy Keynes’ criteria for moving

on to his recommendation for the necessity of drastic social changes to

increase consumption. The

final part of his quote basically suggests that once the economy has

reached that point, more monetary policy actions will have little

effect. I would argue that

monetary policy has had more of a detrimental effect, but we are looking

here at the perspective of our political leaders to anticipate what they

may conjure up next.

So, that leads to the

action of “drastic social changes directed towards increasing

consumption.” If we did not

have gridlock in Washington, we would already be seeing the beginnings

of such action. Who knows

what types of actions the government may think of but we will likely see

tax and spend programs surface that are more radical than we have seen

before. If you do not think

so; who would have imagined as late as 2006, the radical monetary

actions that have subsequently occurred?

Remember, the

politicians have a strong incentive to be able to tell their

constituents that they are doing something to help the situation.

The problem is that much of the problem comes from what they have

done before, so more radical ideas are likely to dig the hole deeper.

Think this is far-fetched?

Just remember the social agenda a number of years ago by our

government, that everyone should own a home.

That “entitlement” subsidized purchases of homes with too much

cheap and easy debt by people who were not in position to afford it, and

that led to a massive bubble and bust.

IT’S ABOUT WHOM HAS THE

PROCLIVITY TO CONSUME…

One factor that will

likely influence the “drastic social changes directed towards increasing

consumption” is the growing income gap between the middle-to-low income

earners and the high income earners.

The gap is at historical highs and many of the initial tactics

will likely be focused on taking more from the high income group and

trying to push it into the hands of the lower income group for the

purposes generating more “consumption” [which is spending] in the

economy. Just read the

latest thoughts from Mohamed El-Erian who used to be the CEO of Pimco

and is a significant influencer of economic policy within the

government.

“Income inequality has

risen so much that consumption as a whole is undermined.

That’s because rich people have

a much lower propensity to consume than poor people.

But it is the rich people that

have captured all the income growth for the last seven years.”

“A little bit of

inequality is good for the system because it creates incentives.

A lot of inequality actually

creates negative economic effects. It

has become an inequality of opportunity.”

“The government should

be using fiscal policy – taxing the rich more and supporting the sectors

that are critical to equality of opportunity: like education and health.

I would remove loopholes that are being taken advantage of by the

rich. I would tax private equity

[more]. The inheritance tax

should be higher.”

It is ironic that many

of the same people as well as the government who encouraged this extreme

monetary policy which is THE driving force behind the income gap, are

now the same ones saying that the government needs to do more to solve

the problem. They are now

looking to take from the segment of the population that their own

policies benefitted the most.

If you step back and think through the progression of government

and monetary policies over the last two decades as well as anticipate

what is to come, you find yourself in a vortex of circular reasoning and

hypocrisy. Need just one

example to get your thoughts going:

government spends, government issues bonds [debt] to finance the

spending, government prints money to buy the same bonds itself is

issuing.

The combination of weak

economic growth, extreme monetary policy that has exhausted itself, a

growing perception of inequality between economic classes and a

government with the proclivity to “do more” is a recipe for “drastic

social changes” prescribed by Keynes.

According to Keynes, the drastic social changes are supposed to

be targeted at increasing consumption in the economy to try to revive it

in the midst of failing monetary policy.

As El-Erian said, lower income groups have more propensity to

consume [spend] from incremental income than higher income groups.

That is why we are likely to see these anticipated “drastic”

measures to be fueled by an underlying motive of redistribution of

wealth. In a sense what

they are saying is that, “Since our monetary policies benefited the

wrong group, we are going to take more overt measures to get that money

back and put it in the hands of those which our political leaders say

they are helping in all of their speeches.”

Remember the quote from one of our Presidents who had some of the

best lines, “The most terrifying words in the English language are ‘I’m

here from the government, and I’m here to help.’”

Even though the next

significant push by the government to try and fuel economic growth may

come from the fiscal side, we will continue to see the Fed use monetary

policy in an active way.

Even though they have communicated that they want to raise rates

possibly in June, I continue to think that they will either not raise

rates this year or if they do it will later be viewed as a policy

mistake by the financial community.

FED IS FAILING ON BOTH ITS

MANDATES…

Not only has growth

slowed back down as we will see first quarter GDP come in between zero

and one percent, but the deflationary pressure that the Fed is concerned

about continue. Let’s look

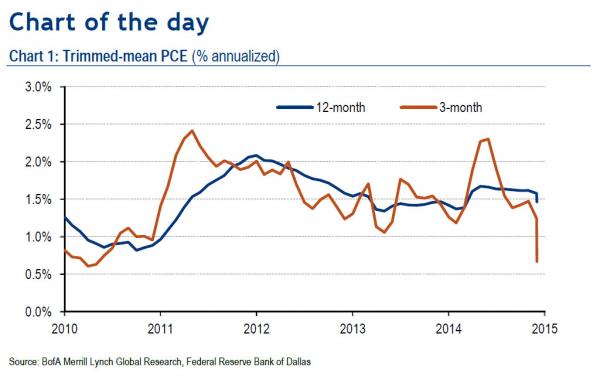

at a few charts to illustrate this.

First, this is a view of one of the inflation metrics the Fed

watches her in the U.S.

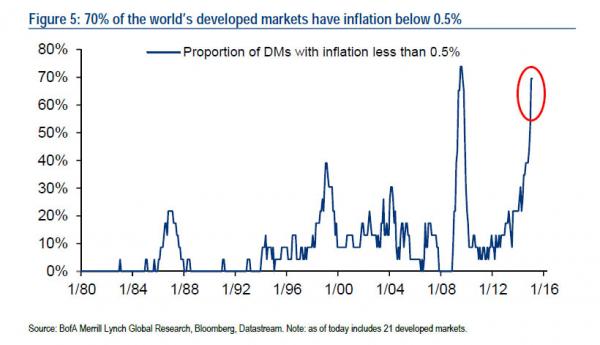

This next chart shows

that 70% of the world’s developed markets have inflation below 0.5%

which is getting close to the reading at the peak of the financial

crisis in 2008. This is

reflected in the fact that trillions in the global bond markets

currently have negative yields.

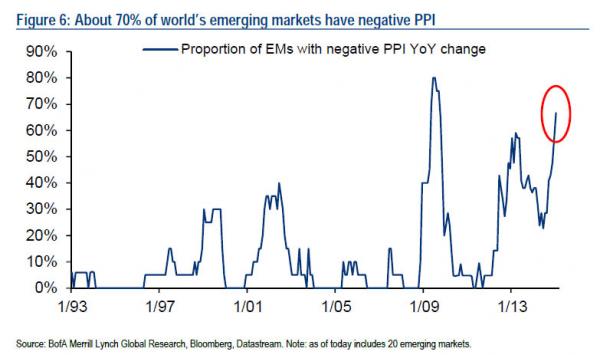

This next chart shows

that about 70% of the world’s emerging markets have negative inflation

rates on the producer prices end, or corporate inputs.

These inflation metrics

suggest that global monetary policy is going to continue to be very

active and Europe’s big round of money printing is just getting ramped

up now.

STARTING TO SEE MORE SIGNS OF

EXTREME SPECULATION…

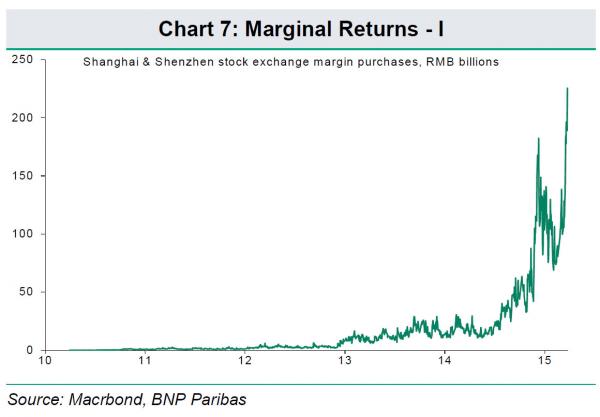

This continued

aggressive global monetary policy may also continue to fuel speculation

in financial assets. I have

discussed numerous times about record margin debt here in the U.S.

However, it has not reached the vertical rise seen in China.

Here is a chart showing stock purchases on margin in China.

SHIFTING GLOBAL ECONOMIC

POWER…

On the subject of

China, an interesting development occurred in the area of global finance

in March. Here is a summary

by a Reuters’ article on March 22.

“Sometime geopolitical shifts happen by accident rather than

design. Historians may

record March 2015 as the moment when China's chequebook diplomacy came

of age, giving the world's number two economy a greater role in shaping

global economic governance at the expense of the United States and the

international financial institutions it has dominated since World War

Two. This month European

governments chose, in an ill-coordinated scramble for advantage, to join

a nascent, Chinese-led Asian Infrastructure Investment Bank (AIIB) in

defiance of Washington's misgivings.”

Since China was not receiving the influence it desired in the

IMF, they decided to create their own world bank and many of our allies

quickly joined against our wishes.

So far, this will have minor influence but it is a development

worth monitoring as there is an underlying sense that world governments

want to diversify away from a U.S. dollar centric world of influence,

trade, and monetary exchange.

Let’s wrap up for this

month. Since our policy

leaders pursue economic thought by Keynes, it will be useful to know

what actions he would have likely taken at this point in the economic

cycle. It looks like the

focus as some point relatively soon may shift from the monetary side to

the fiscal side. While

monetary policy will remain at extreme levels, there will be an

incremental push from the tax and spend mindset to shift dollars from

high income earners to lower income earners.

This redistribution strategy to reinvigorate consumption in the

economy by moving dollars to those with a greater propensity to spend

will have plenty of its own unintended consequences.

THE PIPER WILL EVENTUALLY GET

PAID…

If the Federal Reserve

and the government let the free market finish the cleansing process

started in 2008, we would not be in this quagmire now.

There are those that think we would be much worse off, but I

think the pain in ’08 would have lasted longer and would have been

worse, but it would have been healthy from a longer-term perspective and

we would be back on a productive course by now.

Instead, the global economies still face a day of reckoning and

all of the monetary actions by global central banks have only fueled

more excesses that we have to deal with at some future date.

For now, the

speculation continues as it has only paid to follow the printing press

and ignore the fundamental supports like antiquated metrics such as

valuation. Just don’t lose

sight of what is likely to come.

Joseph R. Gregory, Jr.