TO RAISE, OR NOT TO RAISE

March 7, 2015

The employment numbers

just released for the month of February showed job gains of 295,000 and

the unemployment rate fell to 5.5%.

The headline numbers were much stronger than anticipated so the

immediate reaction was an increase in expectations that the Federal

Reserve will begin to raise rates starting in June.

Interest rates rose across the curve sending stocks down,

especially those that pay higher dividend yields.

This month, let’s take

a look at whether the immediate reaction by the market to the latest

jobs numbers will likely continue.

How this scenario plays out will be a primary driver for global

markets for the rest of the year.

In the midst of this

latest focus on whether or not our central bank will raise rates, let’s

first see what other central bankers are doing because once the world

enters the currency competitive devaluation game, it’s all relative.

During the month of February, at least 20 central banks around

the globe cut rates or eased monetary policy which in effect covers over

50% of the world’s population.

March is starting out with a bang too, as the European Central

Bank [ECB] will start their open ended quantitative easing program on

Monday, March 9th, by printing 60 billion euros a month.

So, while the world continues to push the pedal to the medal with

easy monetary policy, and market participants now expecting our central

bank to actually raise rates in June, what do you think has happened to

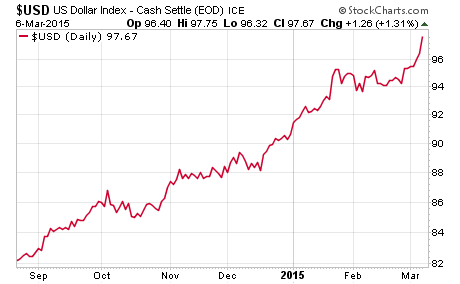

the U.S. dollar?

The chart above shows

that the U.S. dollar against the trade-weighted basket of currencies has

risen over 20% in the last seven months.

That is a very significant move in the currency markets.

So, while the world

central banks continue to aggressively ease monetary policy, causing

most every currency around the world to slide at an increasing rate

against ours, are market participants going to be correct in predicting

that our Fed is going to start raising rates for the first time in

almost seven years off the zero bound?

I don’t think so…

Actually, as I have

mentioned recently, either they will not raise rates this year, or they

will and the market will subsequently view it as a policy mistake.

I would have preferred that the Fed never dropped rates this low

in the first place and they should have raised them earlier.

Cutting rates to the zero bound and leaving them there for so

long increasingly puts the Fed into a box making it more and more

difficult to normalize rates.

Now, let’s look at some

recent data to see how likely the Fed is to start raising rates.

First of all, the quality of the job additions continue to be low

tier as bars and restaurants are the leading category of new hires.

Any consumer savings from the drop in gas prices looks to be

going toward eating out with what is left over from paying increases in

health care.

SHOW ME THE MONEY…

In addition to the

types of jobs, we can look at wage growth to get another indication of

the health of the job market.

The chart above by ECRI

shows average hourly earnings growth.

This weak trend indicates that the underlying employment picture

remains subdued and makes it no surprise that the latest personal

consumption data continues to be weak as well.

IS THE U.S. ECONOMY ABOUT TO

GET STRONGER???

Let’s take a look at

the latest weekly leading index by ECRI to get a sense of whether or not

we should expect the economy to pick up any steam as the headline

employment data suggested today.

If you look at the

recent growth rate of ECRI’s leading index, it has dropped considerably

and this tends to lead the economy by four to six months.

PROFITS OFTEN LEAD THE

ECONOMY…

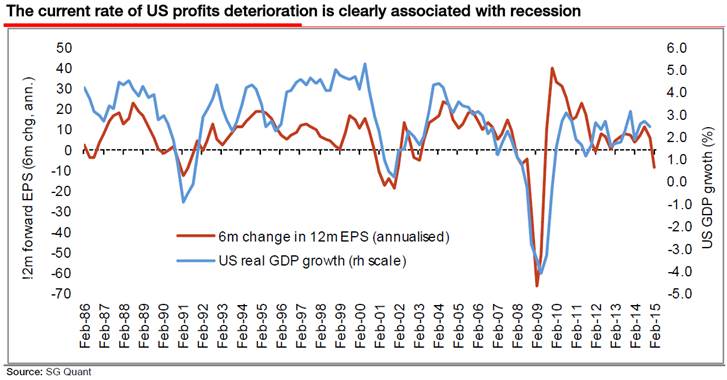

Now, let’s look at

profit expectations. The

following chart by Albert Edwards at SocGen shows the 6-month change in

earnings expectations for the upcoming year with the red line.

Then, he shows real U.S. GDP growth in the light blue line.

This chart covers roughly the last 30 years.

Looking at the right

side of the chart, you can see the sharp drop in expected earnings

growth. Then, look back

over the chart and you can see that this red line of earnings

expectations tends to lead the blue line of GDP growth.

Also, if you look back to the previous time the red line dropped

this low, it has been associated with the start of a recession such as

1991, 2001 and 2008.

OUR INFLATION UNDER THE

EUROPEAN PARADIGM…

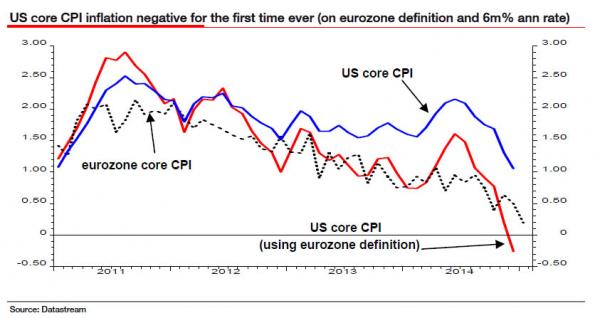

Next, let’s look at

another interesting view of inflation that Edwards at SocGen created

with the following chart.

The chart above shows

the 6-month annual rate of change on different inflation metrics.

The blue line is the U.S. core CPI and you can see the latest

trajectory. Then, the

dotted line is the Eurozone core CPI which shows weaker inflation

numbers than the U.S. Then,

Edwards shows an interesting line with the red one.

That shows what the U.S. core CPI would be using the definitions

that make up the Eurozone CPI.

Looking at this metric which you could argue makes more of an

apples-to-apples comparison, helps to put the global inflation picture

into better perspective. By

the way, the ECB is just now launching their open-ended QE program

because of this inflation picture, in addition to wanting a weaker

currency.

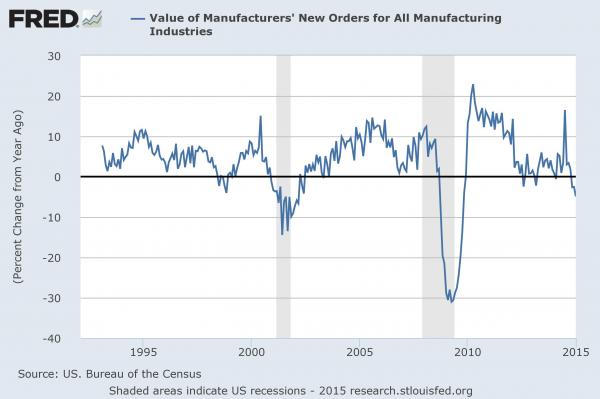

NEW ORDERS FOR FUTURE GROWTH…

Let’s continue on…

The next chart shows the value of manufacturers’ new orders for

all manufacturing industries here in the U.S.

Looking back through

the chart above, usually when this drops this low, we are entering a

recession.

GLOBAL ECONOMIC GROWTH AS

SEEN BY GOLDMAN…

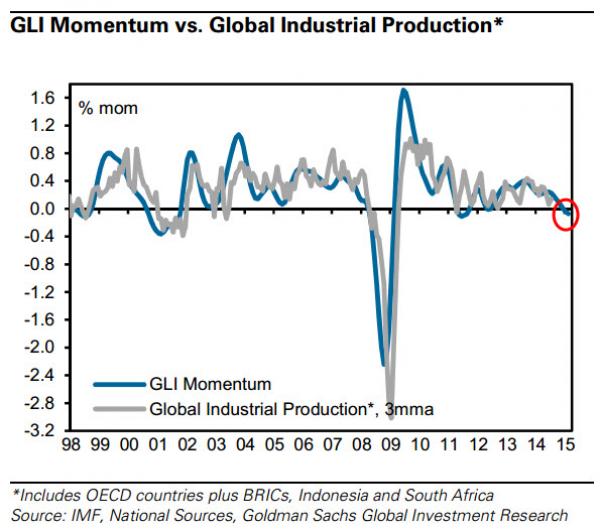

Now, let’s look at the

global economic picture to get a sense of why all most all of the other

central banks around the world continue to ease monetary policy in

aggressive, and previously thought to be unorthodox, ways.

We can do that by looking at two charts from Goldman Sachs.

The first chart shows

their GLI Momentum indicator versus global industrial production.

GLI stands for global leading indicator and suggests the upcoming

path to global economic growth.

The chart above shows

that Goldman’s indicator is suggesting continued global economic

weakness that is getting weaker.

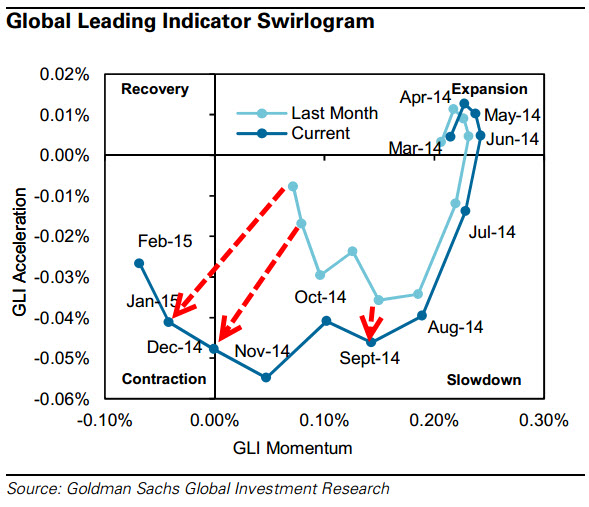

We can put that

longer-term chart into closer perspective with the following chart.

The chart below shows that same GLI Momentum in what they call

their Swirlogram. Don’t you

love how economist can create all kinds of charts to illustrate a point

[even though I can’t complain too much since I am using it to help make

my point]…

Anyway, let’s try to

simplify it. The chart

shows four quadrants, one for economic recovery, then expansion, then

slowdown and in the lower left, economic contraction.

The light blue line shows how their global leading economic

indicator was tracking last month and the darker blue line shows the

most recent readings. They

do not reveal what causes the adjustments but it is likely a mix of

revised previous economic data as well as updates to the latest economic

reports.

Then, if you track the

path of the dark blue line, you can see what their global leading

indicator suggested since beginning back in March of last year.

The main point we want to focus on is that it has migrated from

expansion, to slowdown and now has moved firmly into the contraction

quadrant.

So, Goldman’s Global

Leading Indicator is now suggesting that the global economy is moving

toward not just a slowdown but into a contraction.

Let’s wrap up…

We have had a string of monthly job reports which on a headline

basis seem very strong.

Yesterday, market participants shifted notably in strengthening their

convictions that the Fed is going to raise rates beginning in June.

Now, go back and take a quick review of the charts above showing

wage growth, ECRI’s leading indicator for the U.S. economy, U.S. profit

expectations, U.S. inflation data, new orders for the manufacturing

sector, and Goldman’s leading indicator for global economic growth.

Also, note that the government jobs numbers are a lagging

indicator for economic purposes.

Now, put that in

context of our Federal Reserve’s modus operandi and you may come to the

same conclusion that it will be surprising if they actually do begin to

increase rates in June. Our

Fed started this game of competitive devaluations and they are rapidly

getting behind the others that have joined the game.

That adds another dimension to the prospects of rate hikes that

the Fed normally does not face in trying to normalize policy.

If the Fed does go

ahead and raise rates based on the headline employment numbers, and

these various leading indicators are anywhere near correct, financial

markets will not react well and the market pundits will be out all over

the TV blaming the Fed for a late 1930’s type of policy mistake later

this year.

RIDE THE ECB TRAIN…

Before I close, let’s

address two final thoughts.

One is that the market is already front-running the ECB with money flows

starting to turn rapidly toward investing in Europe.

Market participants have already seen that the money printing by

our Fed did not go into the real economy but rather into financial

assets and they are expecting the same dynamic in Europe, which is has

pretty good odds. Same

thing happened in Japan as well, so why not Europe.

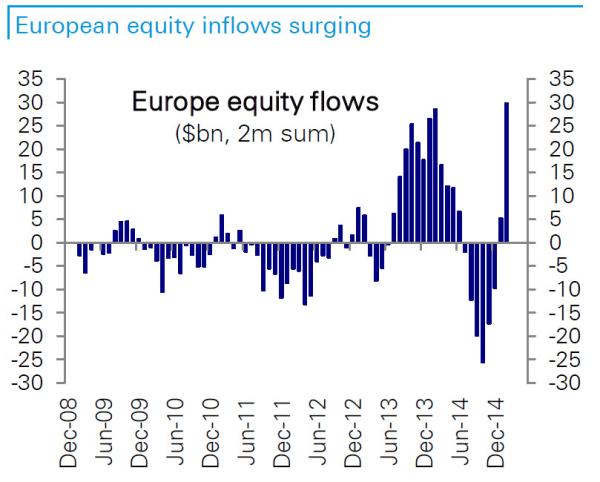

Here is a chart showing the latest money flows into European

equities. The spike in the

last bar on the right show the greatest monthly inflow in quite a while,

right before their open-ended QE starts.

The final point for

this month is that we are starting to see signs of the next phase of the

playbook when it comes to game theory and the global fight for growth

through trade, while battling deflationary pressures.

A few years ago, when our housing bubble popped and we went into

a recession and financial panic, the global economies began to weaken as

well. Bernanke started the

world down this path of printing money to inflate asset prices and

deflate our currency and try to resuscitate slow domestic growth through

the wealth effect and by capturing more of global trade.

Remember, as your currency declines, your country’s goods become

cheaper for others to purchase around the world.

Now, we have seen all

the global central banks join this game of trying to depreciate their

currency. This is not an

“absolute” game but a “relative” one because currencies are all priced

relative to another one. As

one central bank acts, the next one must act with more force or in a

timely fashion to gain the next competitive edge in the currency game.

That is why it is called competitive devaluations.

Each country is competing against the other to have the weaker

currency and make their products cheaper.

NEXT PHASE OF THIS GAME

THEORY GETS INTERESTING…

The next phase in the

game of countries competing in this environment is trade protection.

When one of the players starts to see an endpoint for what they

can do on the currency front relative to the other players, they begin

to resort to other tactics.

The next tactic is protectionism and we are starting to get a whiff of

that in our Congress. We

led the world in this currency game and we may end up leading the world

to the next phase.

Here is a report from

Reuters on February 9th.

“A bipartisan group of U.S. lawmakers will unveil legislation on

Tuesday aimed at stopping trading partners from manipulating their

exchange rates to gain a competitive edge amid a wider debate over using

trade deals to punish currency cheats.

Democratic Senators Sherrod Brown, Debbie Stabenow and Charles

Schumer will be joined by Republicans Jeff Sessions and Lindsey Graham

in presenting the measure.

The legislation, which is similar to bills introduced in previous years,

would treat currency undervaluation in a similar way to subsidies

provided by foreign governments and allow U.S. companies to seek

compensatory duties on imported goods.

It will also set out consequences for countries that fail to

adopt appropriate policies to eliminate currency misalignment, according

to a joint statement from the senators.

An identical bill is planned for introduction in the House of

Representatives by Democrats Sander Levin and Tim Ryan and Republicans

Tim Murphy and Mo Brooks.

Many lawmakers are also

keen to write rules against currency manipulation into free trade

agreements such as the Trans-Pacific Partnership. The 12-nation TPP

includes Japan, whose currency has depreciated about a third against the

U.S. dollar over the last three years.”

This is so unbelievably hypocritical since our Federal Reserve

started this whole mess of printing money in the first place.

Bernanke started this

game and it looks like it is going to get more interesting yet…

Joseph R. Gregory, Jr.