"POLICY MISTAKE"

January 11, 2016

My last market

commentary was titled, “Global Recession Risks Are Rising.”

This month, I want to highlight how probabilities have increased

for a global recession based on the price action in various areas of the

market. I will also include

a few new data points on the economic front.

First of all, the first

week of the New Year was the worst first week for the stock market of

any new year since 1930.

The S&P 500 is now down about 10% from its high last May.

However, the weakness in many areas of the market is much more

significant than the broader averages.

We can look at some of these areas to see if they suggest what

may be going on with the economy.

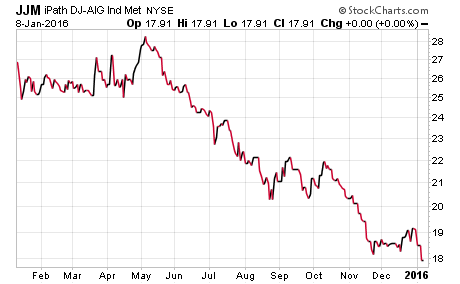

Base metals like

aluminum, nickel, zinc and copper are core metals used in the economy.

The chart below shows an ETF which tracks a basket of these metal

prices.

You can see how the

prices of these economically sensitive metals have been declining

sharply and the basket is down over 35% from its recent high.

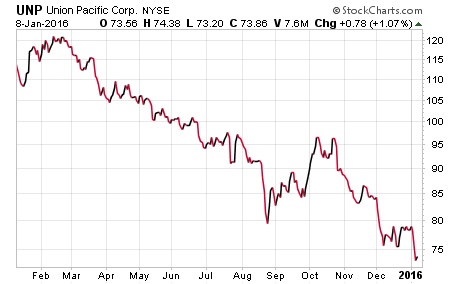

Next, let’s take a look at the stock prices of a few

transportation companies since those companies move the goods within the

economy. The first company

shown below is Union Pacific.

This railroad company transports a wide variety of products.

The chart above shows

how Union Pacific’s stock has dropped by almost 40% recently.

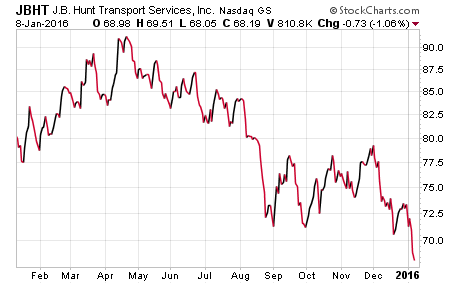

Next, let’s take a look at the largest North American trucking

company; JB Hunt.

JB Hunt’s stock price

has declined by about 26% recently.

From a global transportation perspective, Federal Express’ stock

has declined by a little more than JB Hunt.

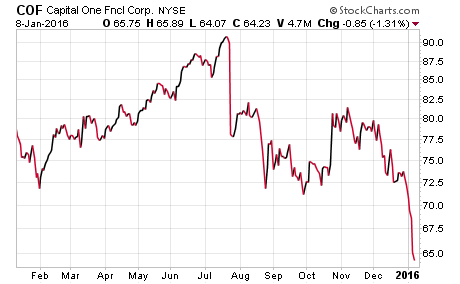

Next, let’s take a look at a stock which is directly affected by

consumer credit and spending; Capital One.

It has over $300 billion in assets and is one of the largest

credit card companies and has significant exposure to other consumer

lending areas such as auto loans.

Capital One’s stock has

declined by 29% recently.

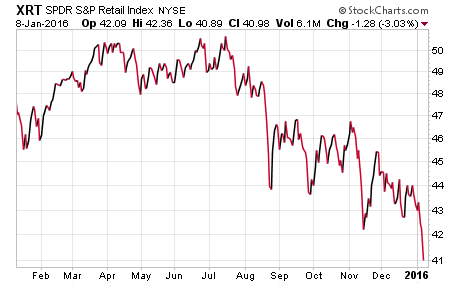

Next, let’s look at an ETF for the retail sector to get a sense of

consumer spending. It is a

very broad-based index of many types of retail companies.

The chart above shows

how the retail sector has declined 20% lately.

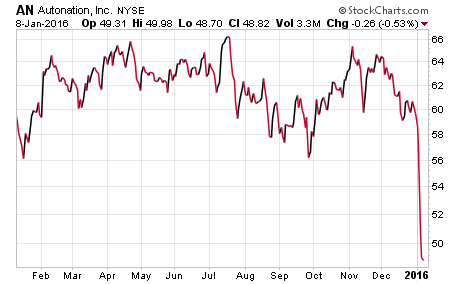

Next, let’s look at what has been the two strongest segments of

the economy; autos and housing.

The first company is AutoNation, which is the largest auto dealer

in the country.

While it had been

holding up in the midst of all the pundits celebrating the strong auto

market, things changed this past week as their CEO said sales are

slowing, promotions are rising, inventory is bloated and the environment

has changed. The stock is

now down around 26% from its recent high.

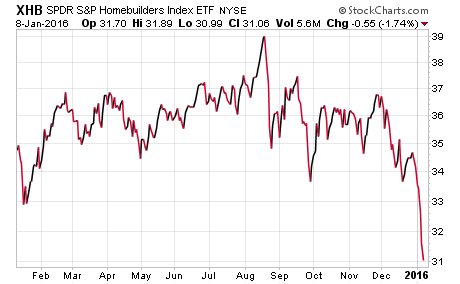

Next, let’s look at the homebuilders as an indication of the

housing market. Here is an

ETF of the largest homebuilders.

After the recent drop,

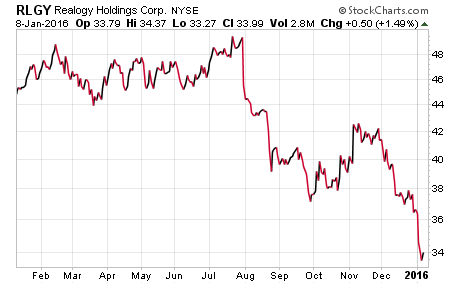

it is down over 20%. Let’s

also take a look at the largest realty company in the U.S.; Realogy.

It has decline by over

30% from its recent high.

Now, let’s look at a few international stock markets.

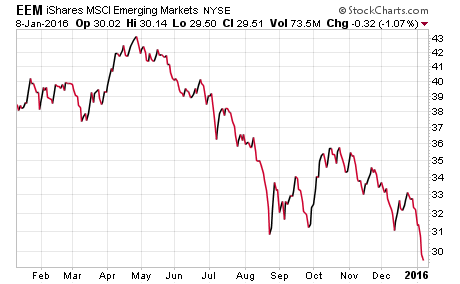

First, here is the broader emerging markets index.

The emerging markets

index has fallen by around 33% recently.

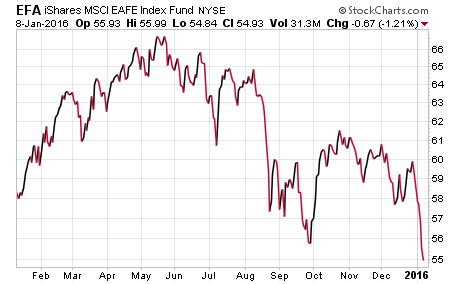

Let’s look at the EAFE index next [Europe, Australia, Far East].

This index has dropped

by more than 21% lately.

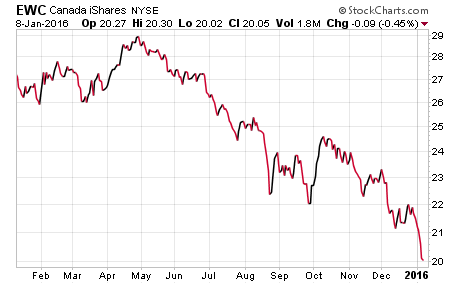

Canada is next.

Canada’s major index

has fallen by 31%. Now

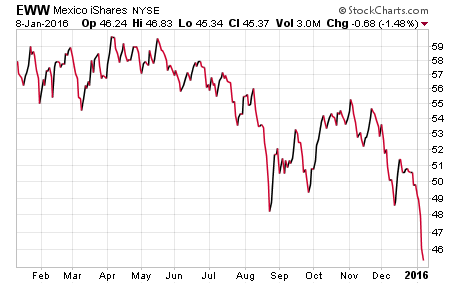

Mexico.

Mexico’s stock market

has dropped by 24% lately.

I could show more, but you probably don’t want to see how bad it is in

some of the economic disaster countries such as Brazil.

Remember, Brazil was one of the hottest areas to invest in not

long ago as it represented the first letter of the BRIC’s acronym.

Also, notice I did not

include Japan which is still a significant part of the global economy.

Their market is starting to roll over as well, but things are so

distorted from all of their monetary policies it is ridiculous.

Bloomberg noted in an article back in October that the Bank of

Japan already owns more than half of their country’s market for ETFs.

That is like Janet Yellen and her crew buying up over half the

stock index funds here in our country to support stock prices.

The charts above

include base metals, railroads, truckers, consumer finance, retail,

autos and housing. Each are

in technical bear markets already, which is a decline of 20% or more.

The significant market declines representing various segments of

the economy further suggests that the ongoing slowdown is likely

developing into the next recession.

The world economy has been slowing, reflected by the

international charts above, and the weakness is increasingly coming onto

our shores. Don’t be fooled

into believing the “decoupling” myth; that the U.S. economy can decouple

from the rest of the world.

GLOBAL TRADE CONTINUES TO

WEAKEN…

Now, let’s look at

trade as another indication of the economy here and around the world.

Here is a chart by ECRI [Economic Cycle Research Institute]

showing both U.S. export volume growth and export prices.

The chart above shows

export volume growth and prices and they are on a trajectory similar to

the last two recessions; in ’01 and ’08.

ECRI also notes that world export volume growth is at a 34-month

low.

A GROWING SUPPLY/DEMAND

IMBALANCE…

Next, let’s look at

business inventories in the economy relative to sales.

Here is a chart by ECRI illustrating this.

The chart above shows

how the gap between inventories and sales is growing wider.

As a result, the inventory-to-sales ratio is at the highest level

since June 2009. This is

going to add pressure for companies to cut production to get inventories

back in line with slowing sales.

It is no wonder the ISM manufacturing index fell further into

contraction territory for the second month in a row.

Raoul Pal, from The Global Macro Investor, recently commented

that the current level of the ISM manufacturing index suggests that the

probabilities of a recession are already at 65%.

Given the latest inventory-to-sales ratio, this ISM reading will

likely continue to decline, raising the probability notably higher.

Before I close, let’s

take a look at two more items; one is corporate balance sheets and the

other is oil inventories.

CORPORATE BALANCE SHEETS NOT

PREPARED FOR A RECESSION…

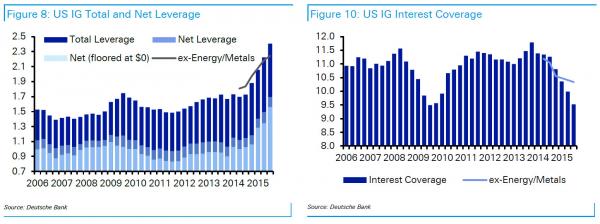

Let’s look at a chart

relating to debt on corporate balance sheets.

The chart above shows

the growing leverage on investment grade company balance sheets in the

first pane and the related interest coverage [ability for companies to

service the debt] in the second pane.

You can see how the leverage is reaching new highs and notably

above the level after the last recession in ‘08/’09.

Also, interest coverage is trending back down toward the levels

seen after the last recession.

It is worth noting that

after a deep recession like the last one, it would not be unusual for

leverage to rise and interest coverage to decline as a result of the

sharp drop in economic activity.

That would be due to a deterioration on the asset side of the

balance sheet and a decline in cash flows.

On the other hand, if you see this deterioration prior to a deep

recession, that is indicative of more obligations on the liability side

of the balance sheet and a related increase in servicing those debts

from an interest coverage perspective.

A notable increase in leverage on corporate balance sheets and a

decline in interest coverage prior to a recession will likely present

greater challenges for CFO’s in the period ahead.

As I have discussed

many times recently, corporate balance sheets have deteriorated and

Goldman Sachs continues to raise red flags regarding this issue.

Excluding the finance sector, they are in worse shape to deal

with a recession than they were at the peak in 2007.

Let’s look at this

issue from another angle.

In a healthy economy, corporations issue debt to fund new projects.

As those new projects are developed, they generate future cash

flows which then provide the means to service the debt that funded the

projects. In the past few

years, corporations have found fewer and fewer new projects to fund, as

evidenced by muted capital spending.

Instead, many have decided to use the cheap financing enabled by

the Fed to issue debt and use the proceeds to buy back stock.

This helps to reduce the number of shares outstanding, and as a

result they get a temporary boost to earnings per share.

However, as corporations have levered up their balance sheets,

the stock they bought back does not generate any future cash flow to

help service the additional debt.

And, they have been buying their stock at elevated valuations.

This focus on short-term stock performance will likely present

longer-term challenges.

SEASONAL PATTERN IN OIL A KEY

FACTOR AHEAD…

Next, let’s take a

quick look at another topic; oil inventories.

So, in December, we saw a notable decline in oil inventories

which has made some analysts more constructive.

The issue is that oil inventories tend to have their biggest

monthly declines in December each year for different reasons such as

taxes. Here is a chart

which shows average changes in oil inventories for each month of the

year.

The chart above shows

how oil inventories usually decline in December by the greatest amount

in any month of the year but then build in the first five months of the

following year. Also, the

recent inventory data for Cushing is showing that storage capacity is

getting very full. While

rig counts continue to decline and production has declined some,

production needs to be cut more to get the balance of supply and demand

back in check. If the

global economy is slipping into a recession, demand is going to decline

as well which puts more pressure back on additional production cuts to

get supply into balance.

Just recently, credit default swaps are indicating more default risk to

Saudi Arabia than Portugal.

As a result of the ongoing supply/demand dynamics and seasonal patterns,

oil prices may flush lower in the period ahead and if so, related

geo-political tensions will likely rise.

WILL 2016 RHYME WITH 1937???

Let’s wrap up.

All of the stock charts that I showed above, which reflect

various segments of our economy as well as the global economy, add to

the evidence that the probabilities of a global recession continue to

grow. Looking at those

charts make the declines in the S&P 500 seem very mild, even after the

worst first week in a new year since 1930.

It is likely time for the major indices to play a little catch

up.

One of the building

concerns for the U.S. economy is the growing gap between inventories and

sales. Exports are not

helping corporations either as global trade continues to weaken.

Finally, corporate balance sheets are not well prepared to deal

with a recession as they have levered up in order to achieve short-term

performance metrics through stock buybacks, partly due to pressure from

their investors.

The final point in the

discussion above relating to oil prices is important since the general

market has been tracking the direction of oil in recent weeks.

If oil prices break into the 20’s in the coming period, it will

add further pressure to the overall market.

Now, consider the Fed

and their recent decision to raise rates.

I said all last year that they will either not raise rates or if

they do, it will subsequently be viewed as a policy mistake.

They should not have ever into entered this black hole of

unconventional policies but Bernanke led the global central banks down

this path and it is becoming increasingly difficult for them to get out

of it. You are going to

hear more and more about the implications of a “policy mistake” similar

to 1937 as this year progresses, especially if the global economy is

entering a recession. The

Atlanta Fed GDPNow model, which incorporates the latest economic data is

suggesting that 4th quarter GDP has decelerated down to 0.8%

growth here in the U.S.

We led the Europeans

down the path of printing money and I think they are going to lead us

and Canada down the path of negative rates.

Remember, this is about what the Fed will likely do and not about

what they should do. I

think Janet Yellen and her team will likely realize that they raised

rates just ahead of a recession and they will reverse course.

However, they will not stop at the zero bound this time but go

negative and start printing again, as that is what the Europeans are

doing as we speak. Who

knows, maybe both the Europeans and the U.S. will join Japan’s central

bank and start buying stocks too.

If our stocks start dropping like they did in 2008, you can bet

on it. It’s as if one

central banker comes up with an idea and all the others eventually

follow. Goldman Sachs notes

that the Chinese government bought at least CNY1.8 trillion of equities

in the second half of last year.

The global central

banks are pursuing unconventional policies into the abyss.

We will all be surprised just how far they go and it will

continue until everyone realizes this grand experiment failed.

Remember, monetary policy is being set by just a roomful of

academics. In July of 2007,

when many signs were flashing warning signals of the upcoming crisis,

here was Bernanke’s and the Fed’s forecast: “Overall, the U.S. economy

seems likely to expand at a moderate pace over the second half of 2007,

with growth then strengthening a bit in 2008 to a rate close to the

economy’s underlying trend.”

This is very similar to Janet Yellen’s and the Fed’s forecast

now.

Joseph R. Gregory, Jr.