DEFLATION AND INFLATION AT THE SAME TIME

January 9, 2015

As we enter the New

Year, the economic and market environment continues to wrestle with two

opposing forces. We are

seeing deflationary pressures from the growing global debt and subdued

economic growth while at the same time, inflationary pressures continue

from the monetary policies of global central banks.

Let’s take a look at both.

To start, let’s see

where the deflationary pressures are evident.

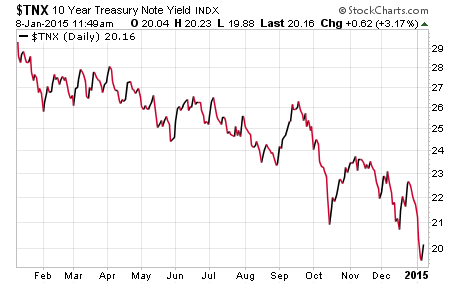

The chart below shows the U.S. 10-year Treasury bond yield.

The 10-year yield has

dropped from around 3% a year ago to below 2% recently.

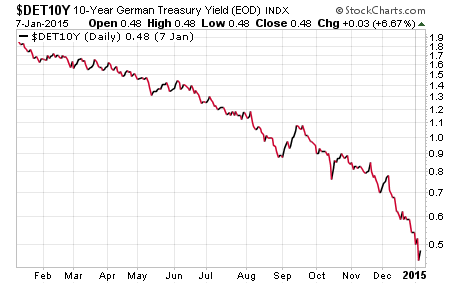

Next, here is the

10-year German Bund yield.

This drop is more

significant at it has fallen from about 1.8% a year ago to about 0.45%

recently.

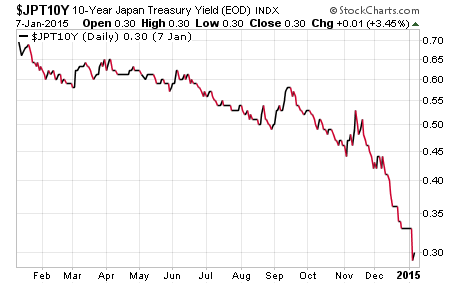

Next, let’s look at the

10-year yield on Japanese government bonds.

This yield has dropped

from around 0.70% a year ago to under 0.30% lately.

One explanation of the

drop in the yields of U.S. government bonds is that money is coming into

the best economy among weak established economies which is evident in

the strong rise in the U.S. dollar relative to the Euro and the Yen.

And, those money flows are going into our Treasury bonds driving

yields lower. However, if

that was the primary reason for the drop in yield we probably would not

be seeing a collapse in the yields of the government bonds related to

both of those currencies where money is leaving.

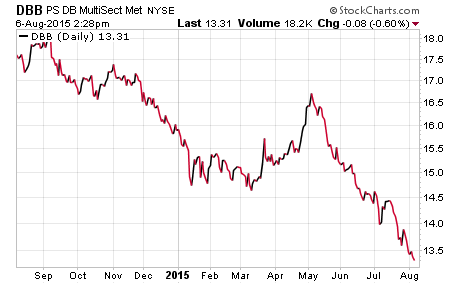

Now, let’s move to

another asset class, commodities.

Here we can take a look at metals, agriculture and the latest

obvious one, oil. First,

here is an ETF of industrial metals or some of the most used metals in

the economy such as copper, aluminum and zinc.

This chart shows the

decline over the last 5 months, which is about a 14% drop.

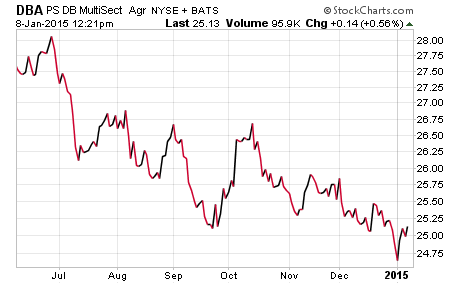

While agriculture

prices are more of a reflection of weather and plantings, it is still

interesting to take a quick look.

The chart above shows

about a 12% drop in agriculture prices such as corn, wheat and soybeans.

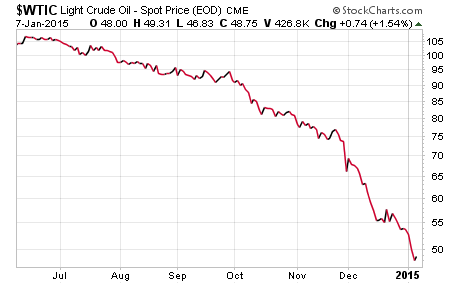

Next, here is a chart

that shows the collapse in oil prices.

Oil prices have dropped

over 55% in the last 7 months.

Now, let’s take a look

at inflation expectations as shown in a chart by BofA Merrill Lynch.

Without going into the

details of this metric, you can see by the trajectory of line at the end

of the chart, inflation expectations are dropping at an accelerating

rate. They are lower than

at any time since the financial crisis in 2008 and at the pace of this

decline, we are likely to see it break below that crash level soon.

So, what we are seeing

from a deflationary standpoint is global government bond yields

declining sharply, commodity prices dropping notably and inflation

expectations rapidly heading toward the lows at the peak of the scare

during the financial crisis.

The scare of deflation for economic and market participants is

that if it starts to accelerate then purchases in the economy are

delayed because purchasers believe they can get a better price the

longer they wait and economic activity is then in trouble.

Personally, I don’t mind a little deflation.

However, the Federal Reserve is especially worried about

deflation in this environment because they see inflation expectations

dropping sharply after printing all this money and keeping rates at

zero, and they know there is not a lot left in their arsenal.

The primary drivers of

the deflationary pressures are global debt and related weak economic

growth. The Geneva Report

is commissioned annually by the International Centre for Monetary and

Banking Studies. The latest

report takes issue with all the discussions around how debt burdens have

been reduced since the economic crisis in 2008.

The report discusses how there has been a rapid rise in public

sector debt among the developed countries and private sector debt in

emerging countries, especially China.

It reports that total world debt has risen from 160% of national

income in 2001 to 200% in 2009 at the end of the financial crisis to

215% in 2013. The IMF put

out a study reporting that global debt markets have risen from $70

trillion in 2007 to $100 trillion in 2013.

INFLATION CAN BE IN MANY

FORMS…

Now, let’s turn to

discuss where we are seeing inflation in the current environment.

Here, I am not talking about the rising cost of education and

healthcare as I see that being an issue with the dynamics of the way

those sectors are structured, funded and operate; both of which are

highly dysfunctional.

Instead, it is inflationary pressures that are coming from global

central bank monetary policies.

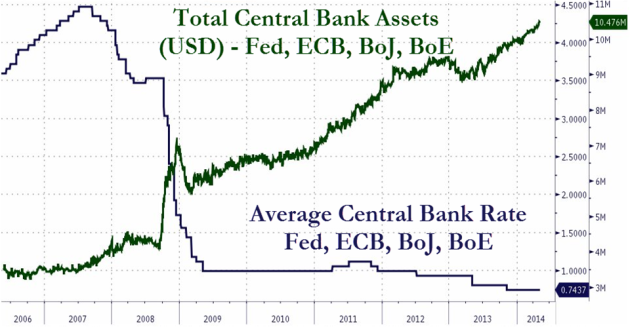

To illustrate just how extreme monetary policies have been and

are going, we can look at the chart below from resilience.org from

googling global central bank balance sheets.

The chart above shows

the combined balance sheets of our Fed, the European Central Bank, the

Bank of Japan and the Bank of England in the dark green line.

Then, the average of the yields controlled by these central banks

is in the dark blue line.

This illustrates just how extreme monetary policy has gone and it is

going to get even more extreme.

We have never seen this in history.

Economic theory would

indicate that all of this easy money will create inflation.

Well, the inflation so far has not shown up in the real economy

such as wage inflation and commodities but rather in financial asset

prices; i.e., the stock market.

The central banks have

printed all this money and moved rates of return on safe assets for

savers to basically nothing.

So, where do the savings stored up go?

Instead of the money going into consumption, as reflected by weak

global consumption, much of it has gone into riskier financial assets.

However, the plan by the Fed to ramp up the prices of financial

assets to create a wealth effect so as to encourage consumption, so far

has not worked.

INTERESTING EARNINGS

ENVIRONMENT…

The issue with

investors chasing the inflation in stock prices is that it is based more

on the manipulation by central banks through monetary policy, when the

fundamentals are more in sync with the deflationary forces reflected in

government bond yields and commodities.

If you listen to the financial media they justify stock prices

rising because earnings are doing well.

But, then when asked why are global bond yields crashing along

with declines in commodities which reflect economic activity such as

base metals and oil, they say it is due to weak global growth and

deflationary pressures.

Now, how do you get improved earnings from weak global growth and signs

of deflation?

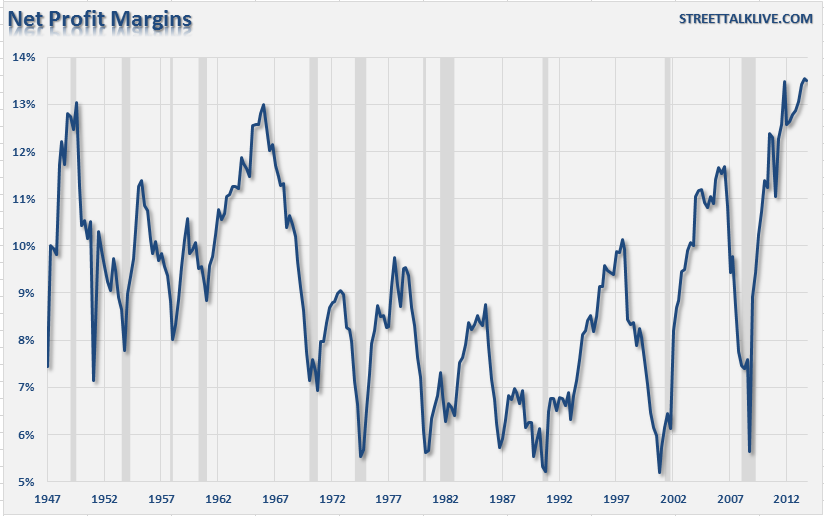

To try to reconcile

this, you can look at profit margins and financial engineering.

First, let’s look at profit margins.

As you can see by the

chart above, corporate profit margins are at record highs.

The chart also illustrates that margins tend to be very mean

reverting and do not stay abnormally elevated or depressed for very

long. If you look at the

deflationary pressures, corporate inputs from commodity prices, to wages

they pay, to reductions in interest expense from low rates have all

contributed to the record margins.

Also, financial

engineering has dramatically contributed to earnings.

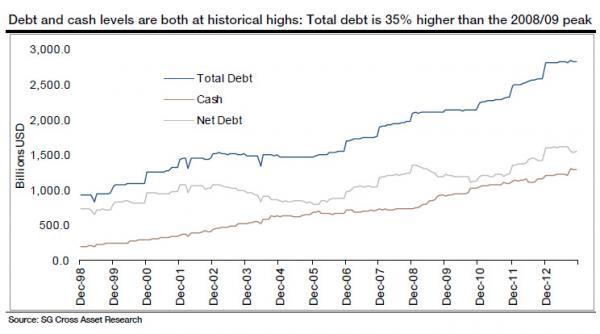

Here is a chart of corporate debt.

This chart shows that

total corporate debt is 35% higher than the ‘08/’09 peak.

Once again, we see that monetary policy has encouraged

corporations to take on more debt.

So, what have the corporations spent all this money on?

Capital expenditure numbers have been very muted indicating that

they are not finding an abundance of attractive new investments to

pursue, especially in the environment of weak global demand.

So if you can’t find new capital projects to invest in for future

growth, what can you do to help with earnings?

The answer is, reduce the number of shares outstanding by buying

back your own stock. After

all, earnings per share is calculated by the earnings of a company

divided by the number of shares outstanding.

It is estimated by Standard and Poor’s that companies spent $565

billion this past year on buying their own stock back.

Even with subdued

revenue growth, these dynamics have helped dramatically with making

current price/earnings multiples look more reasonable.

That is why it is a good time to use valuation metrics that

smooth out dynamics such as unusually high profit margins coupled with a

surge in corporate buybacks, such as CAPE [cyclically adjusted price

earnings ratio]. These

valuation metrics are significantly elevated now.

However, financial

engineering of using the effects of monetary policy to issue low cost

debt and fund significant increases in share buybacks doesn’t last

forever. IBM is a perfect

example where eventually top line revenue growth is needed to justify

stock price levels and the benefits of corporate buybacks run their

course. Caterpillar is

another one to watch among many others.

THIS INFLATION ENCOURAGES

RISK TAKING…

So, we have monetary

policy not only encouraging investors to chase stock prices but also

providing the means for corporation to issue cheap debt to fund buying

back their own stock. The

longer the muted fundamentals and deflationary forces continue, the

longer the extreme monetary policies will go on.

However, weak fundamentals and deflationary conditions discourage

capital spending by corporations which is the fuel for future growth,

and future growth is eventually required to support stock prices.

The Fed eliminating any

return on safe assets also tends to encourage investors to extend their

investments further and further out the risk curve over time.

As more investors move incrementally into riskier assets to find

yield and return, those yield and return opportunities are marginalized.

Investors then take the next increment of risk to generate the

same return as they had before in a safer asset.

They enjoy the asset price inflation created by the Fed until

they realize that the assets they now hold are not supported by the

underlying fundamentals found in weak global growth and deflationary

pressures.

COULD FED POLICY ACTUALLY

CREATE DEFLATION???

Now, here is an

interesting scenario that I have not heard discussed among financial

pundits or economists. When

the Fed prints a ton of money and keeps rates at zero for very long

periods of time, everyone expects inflation.

What if we really are getting the expected inflation now in the

form of asset price inflation?

It is the kind of inflation investors love, at least while it

lasts. But, what if the Fed

turns out to be sowing the seeds of much more dangerous global deflation

by the very policies they currently believe are fighting deflation?

What is a side effect

of all this easy money? It

is cheap and easy debt. As

I discussed above, global debt keeps rising at a rapid rate encouraged

by all this “free” money sloshing around the world from the global

central banks, and led by our Fed.

Now, what is a primary

driver of “bad” deflation?

It is deleveraging from high debt levels.

So, while the Fed believes it is fighting deflation with their

policies, we get asset price inflation but deflationary pressures are

still building in a number of areas of the real economy.

The wealth effect they have been looking for is not helping them

address the deflationary pressures they are seeing.

We may see this Fed “medicine” turn out to be fuel for the

deflation fire as the global economies have to eventually address the

massive debts they are financing from Fed policies.

That will be really interesting if the global debt bell rings at

a time when the global central banks have few bullets left.

PAVLOV’S DOG KEEPS BUYING

WHEN THE FED SPEAKS…

On that cheery note,

let’s look at how the market continues to be battling the slowing global

growth but trained to rally on the Fed.

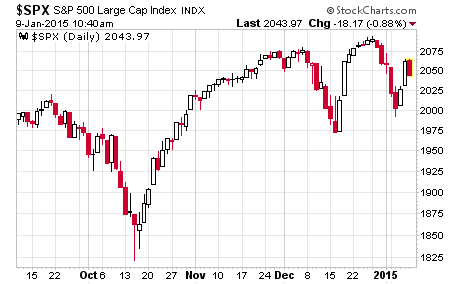

The chart above shows

the action of the S&P 500 since September.

The market started dropping in late September into mid-October.

Then, right at the lows, James Bullard of the Fed came out and

said that they may not end QE like they were planning.

The market immediately started to rally through November.

Then, the market started dropping in early December until the day

of the Fed meeting in which they sounded relatively dovish as far as

raising interest rates and the market once again had an immediate pop.

Next, the market had its worst three days of a new year ever and

what do you know, but another Fed member, Evans, came out and said that

it would be a catastrophe if the Fed were to raise rates anytime soon

and markets pop once again.

It seems now that anytime the market starts to look like it could have a

more meaningful correction, the Fed sends out a member to talk it back

up again. It seems that the

weak global growth is weighing on stock prices but the market is so

conditioned to respond to the words of the Fed that we get this type of

action.

GOLDMAN’S SENTIMENT

INDICATOR…

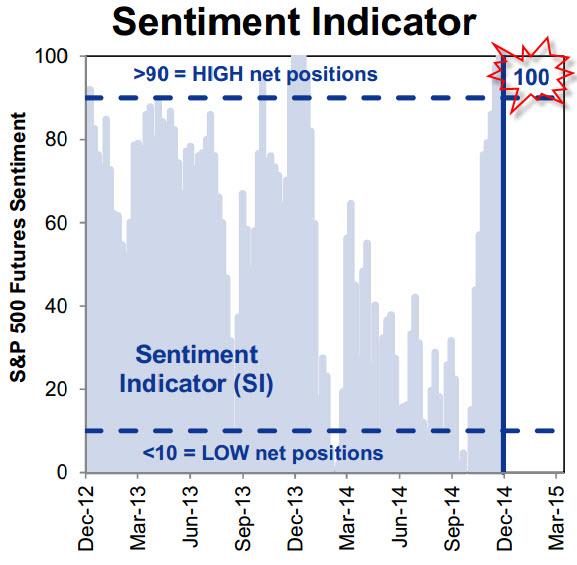

Before I close for this

month, it is interesting that we ended last year with one of Goldman’s

sentiment indicators at its highest possible level.

This indicator is shown

above and represents net positions on S&P 500 Futures contracts.

It was floored at 100 meaning investors were positioned for

maximum future gains from rising stock prices.

This tends to be a contrarian indicator and what followed was the

worst three day start to a new year ever, as I mentioned above.

This positioning may not have been worked down just yet.

As I close for this

month, it is worth mentioning that I have seen an unusually high amount

of distribution under the surface of the market since the beginning of

December. I track buying

and selling pressure on a daily basis by looking at price and volume

movements on the major exchanges.

If this selling pressure continues to build while stock prices

are near their highs, it will likely mean corrective forces will take

hold.

COMMENTS WORTH CONSIDERING…

Also, crashes in the

price of oil are usually associated with unpleasant developments in

financial markets. Here are

a few comments from Jeffrey Gundlach, who is viewed as the new bond king

in financial circles.

“Something between 14%

and 19% of the junk bond market is energy related.

So when you have oil prices

staying where they are for several months

– which is likely because that is a policy decision that some oil

producers have made – some of these companies will start to really run

into financial troubles.

Now, some people are saying:

‘That is confined to energy, it is a pocket of the economy,

everything else is OK and insulated.’

But that argument usually does not work.

When the housing market started to get weak in the subprime

category, even Ben Bernanke said: ‘That does not matter, it is just

subprime.’ But, things are

linked together.”

And for those who are

banking on oil prices providing a net benefit to the economy, here is a

quote from Ray Dalio, the founder of the largest and one of the most

successful hedge funds in the world.

“In its November 14,

2014 Daily Observations (‘The Implications of $75 Oil for the US

Economy’), the highly respected hedge fund Bridgewater Associates, LP

confirmed that lower oil prices will have a negative impact on the

economy.”

“After an initial

transitory positive impact on GDP, Bridgewater explains that lower oil

investment and production will lead to a drag on real growth of 0.5% of

GDP.”

“The firm noted that

over the past few years, oil production and investment have been adding

about 0.5% to nominal GDP growth but that if oil levels out at $75 per

barrel, this would shift to something like -0.7% over the next year,

creating a material hit to income growth of 1-1.5%."

He wrote this

identifying the issues with oil at $75 and it is now at $47, a full 37%

lower.

With oil at $47, here

is a final recent quote from Gundlach.

“Oil is incredibly important right now.

If oil falls to around $40 a

barrel then I think the yield on the ten year Treasury note is going to

1%. I hope it does not go to $40

because then something is very, very wrong with the world, not just the

economy. The geopolitical

consequences could be – to put it bluntly – terrifying.”

To balance these risks

voiced by Bridgewater and Gundlach, David Tepper, another highly

respected investor believes that stock prices may elevate even more.

His rationale is that the European Central Bank is going to be

forced to come into the market soon with significant QE, or money

printing, and we get further asset price inflation since the “free”

money is going into financial assets rather than the real economy.

In light of the growing

cross winds, the environment should provide a very interesting year

ahead for investors to navigate.

We are living in historic times with respect to monetary policy,

economic repercussions and financial asset prices.

Enjoy the ride!

Joseph R. Gregory, Jr.